Under normal circumstances, Americans would be finalizing and filing taxes by April 15, but the tax filing deadline for federal and state taxes has been extended due to COVID-19.

According to the Arizona Department of Revenue (ADOR), however, the deadline to file for the 2019 Tax Credit Contribution Credit remains April 15.

At the end of March, ADOR announced that it would follow federal guidelines and extend filing and payment for individual, corporate, and fiduciary 2019 tax returns to July 15 because of the pandemic.

“The new deadline means taxpayers filing state tax returns or submitting payments by July 15 will not be assessed late filing or late payment penalties and interest,” said an ADOR press release.

Although this is the case, Arizonans wanting to claim tax credits on their 2019 individual income taxes for donations to qualifying charitable organizations, certified school tuition organizations (STOs), and public schools must do so by today.

According to ADOR, Arizona provides two separate tax credits for individuals who make contributions to charitable organizations: one for donations to Qualifying Charitable Organizations (QCO) and the second for donations to Qualifying Foster Care Charitable Organizations (QFCO).

To confirm certified qualifying charities and more information on QCO and QFCO tax credits, taxpayers can visit https://azdor.gov/tax-credits/contributions-qcos-and-qfcos.

“A taxpayer can only claim a tax credit for donations made to certified charities from the list for the year in which the donation was made,” ADOR said. “For example, donations made during 2020 must be to a charity shown on the 2020 QCO or QFCO list.”

The agency added that once confirming an organization is certified, taxpayers are required to use the “QCO Code” or “QFCO Code” to claim the tax credits for contributions. They can visit https://azdor.gov/tax-credits for Arizona’s charitable tax credits and what forms to use.

At this time, customers requiring in-person assistance at ADOR’s three customer service locations in Phoenix, Mesa, and the Southern Regional Office in Tucson will need to make an appointment with a department representative. They can do so by emailing [email protected] or calling (602) 716 –ADOR (2367), ADOR officials said.

Taxpayers can also submit forms, correspondence, and questions directly to ADOR staff through the [email protected] email.

For individuals looking for tax information or needing additional assistance this tax filing season, ADOR suggests the following:

- Free File Alliance – A public-private partnership between ADOR and a consortium of tax preparation software companies. The free file program offers free filing services to Arizona individual taxpayers who meet certain criteria.

- E-File – Visit the Arizona Department of Revenue’s E-Services page to view the list of software providers certified to submit electronically filed returns with ADOR.

- Online Forms – Arizona offers fillable tax forms designed for taxpayers who prefer to prepare their returns.

- Live Chat – ADOR Live Chat is available online Monday through Friday from 7 a.m. to 6 p.m. to answer inquiries for general questions and offers navigational guides in real-time.

- Phone – Customers seeking information on particular private taxpayer matters or confidential account information can speak to our Customer Care at (602) 255-3381 or 800-352-4090.

Politics

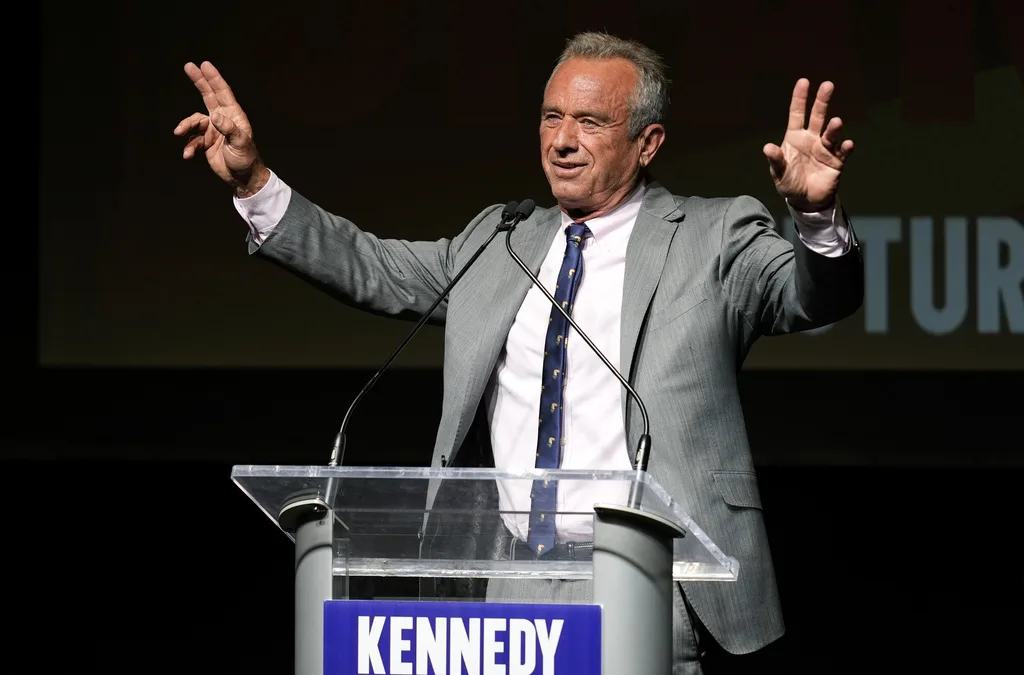

He said what? 10 things to know about RFK Jr.

The Kennedy family has long been considered “Democratic royalty.” But Robert F. Kennedy, Jr.—son of Robert F. Kennedy, who was assassinated while...

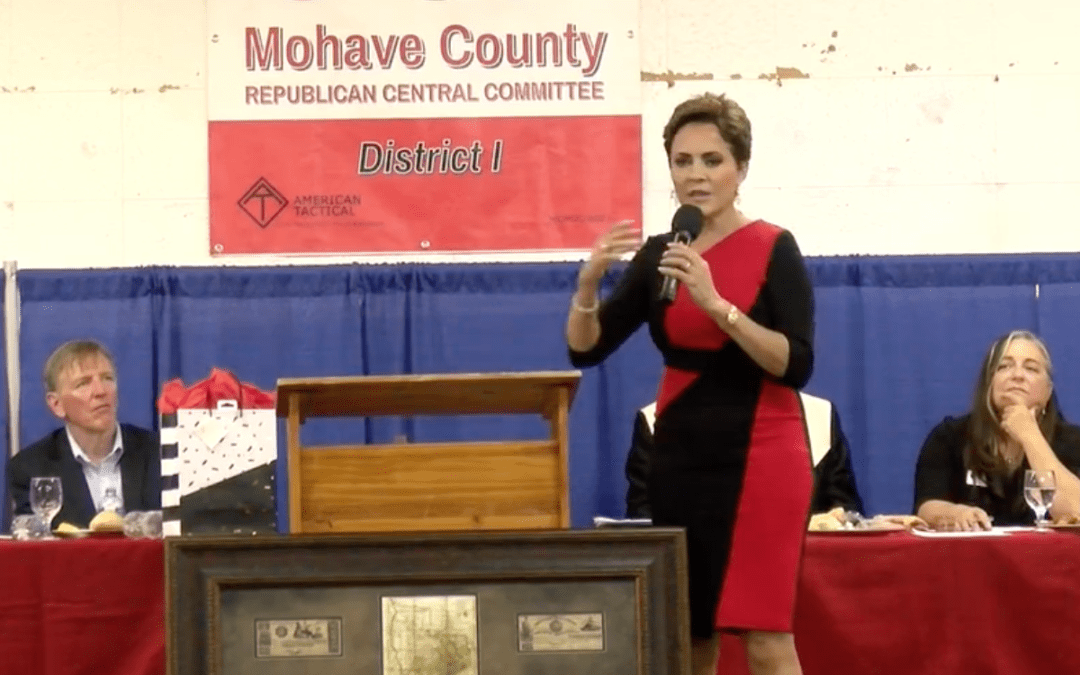

Kari Lake calls on Arizona county sheriffs to enforce 1864 abortion ban

Republican candidate for US Senate Kari Lake on Saturday seemed to solidify her support for Arizona’s total abortion ban and called on county...

Local News

Biden marks Earth Day by announcing $7 billion in solar grants

The Biden administration on Monday announced the recipients of its Solar For All Program, a $7 billion climate program that aims to lower energy...

Opinion: Don’t think Arizona abortion bans are harming women? Think again.

This is part TWO in a series on the increase in violence against women since the US Supreme Court overturned Roe v. Wade, and the future of abortion...