A woman feeds a baby as people wait in line to receive new school supplies, including new athletic shoes donated by Foot Locker, at Fred Jordan Missions on Skid Row, on September 28, 2019 in Los Angeles, California. Fred Jordan Missions, which feeds over 100 people experiencing homelessness daily, hosts the annual event with Foot Locker. They donated new sneakers and other school supplies to more than 3,000 underprivileged and homeless children this year.

The average wealth of white families in 2016 was over $700,000 higher than that of Black and Latino families.

The poverty rate for Black Arizonans is nearly twice that of their white neighbors—but that may change, thanks to a new federal initiative announced earlier this month.

In a speech on June 1 commemorating 100 years since a white supremacist mob destroyed a Black community and killed at least 300 people in Tulsa, Oklahoma, President Joe Biden announced a plan to close the racial wealth gap in the United States by strengthening equal housing legislation and addressing systemic issues.

According to a White House press release detailing the plan, it aims to increase “access to two key wealth-creators—homeownership and small business ownership—in communities of color and disadvantaged communities.”

The White House plan also included additions to Biden’s American Jobs Plan to fund public amenity projects, improve transportation infrastructure, support small business programs, and attract investment in affordable housing.

Biden’s plan an “excellent start”

Michael Neal, senior research associate at the Urban Institute, called the Biden administration’s proposal an “excellent start” because it acknowledges the problem and “backs up the rhetoric with action.”

Neal pointed to a few specific pieces of the proposal as encouraging, such as a reevaluation of home appraisals and ensuring federal funds do not support discriminatory practices.

“The evidence suggests that Black-owned homes and neighborhoods tend to be undervalued relative to homes in white neighborhoods … which has implications for the ability of Black homeowners and Hispanic homeowners as well to accrue the financial benefits of wealth accumulation,” Neal said.

In one example reported by the Indy Star, after two previous appraisals place her home at $125,000 and $110,000, a Black homeowner in Indianapolis felt she was being lowballed and asked a white friend to stand in for a third attempt. The home’s value doubled — $259,000.

The COVID-19 pandemic worsened current housing disparities, as its effects have disproportionately hit communities of color across the nation.

The poverty rate for Black Arizonans is nearly double that of white Arizonans

In Arizona, nonwhite renters are much less confident they will be able to make their next payment due in part to employment loss caused by the pandemic, according to the U.S. Census Bureau Household Pulse survey.

The most recent survey, conducted between May 12-24, found that of the 83,000 respondents unable to make their next rental payment, 74% were nonwhite Arizonans. On the other end, of those confident they will be caught up, 59% were white, while only 3% were Black.

According to a 2019 report by the Kaiser Family Foundation, the poverty rate for Black Arizonans—17.5%—is nearly double the 9.2% of white Arizonans.

In the United States, communities of color—particularly Black communities—have not accumulated wealth the same way white U.S. residents have.

The average wealth of white families, according to a 2016 report by the Urban Institute, was $919,000. That’s $700,000 higher than the $140,000 figure reported for Black families and $192,000 for Hispanic families. This gap is even wider than it was in 1963, when the average wealth of white families was $121,000 higher than nonwhite families.

In terms of homeownership, approximately 42 percent of Black families were able to purchase their own homes in 2016. For white families, that percentage jumped to 68 percent.

‘It’s like trying to go uphill with a ton of bricks in your backpack’

Kiana Sears, president of the NAACP East Valley Branch, said that while the plan is a good first step, she is disappointed that it does not address student loan debt.

“You do not have a level playing field that you can catapult yourself forward, because you have this debt behind you,” Sears said. “It’s like trying to go uphill with a ton of bricks in your backpack that is pulling you back as you’re straining to go forward.”

Neal said that in addition to addressing student loan debt, the Biden administration should also consider down payment assistance for disadvantaged homebuyers and addressing supply and zoning issues “that would support more construction of affordable housing.”

Activists worry plan could spark backlash

Sears worries that if the plan is not implemented correctly, with strong enforcement and follow-up steps, it could add fuel to the backlash against justice efforts. She compared it to ordinances banning discrimination against LGBTQ+ citizens in some Arizona cities and the opposition to similar orders in other cities.

Sears said that Biden’s proposal could be a step toward economic justice, a goal that civil rights leaders have been pushing for since the civil rights movement.

“Everyone always points to Martin Luther King and [his speech] ‘I Have a Dream.’ We got the message, but we missed the point,” Sears said. “If you listen to the speech it was about economic justice: He’s talking about the check that America hasn’t paid, the debt owed.”

Politics

Democrats clear path to bring proposed repeal of Arizona’s near-total abortion ban to a vote

Democrats in the Arizona Senate cleared a path to bring a proposed repeal of the state's near-total ban on abortions to a vote after the state's...

It’s official: Your boss has to give you time off to recover from childbirth or get an abortion

Originally published by The 19th In what could be a groundbreaking shift in American workplaces, most employees across the country will now have...

Local News

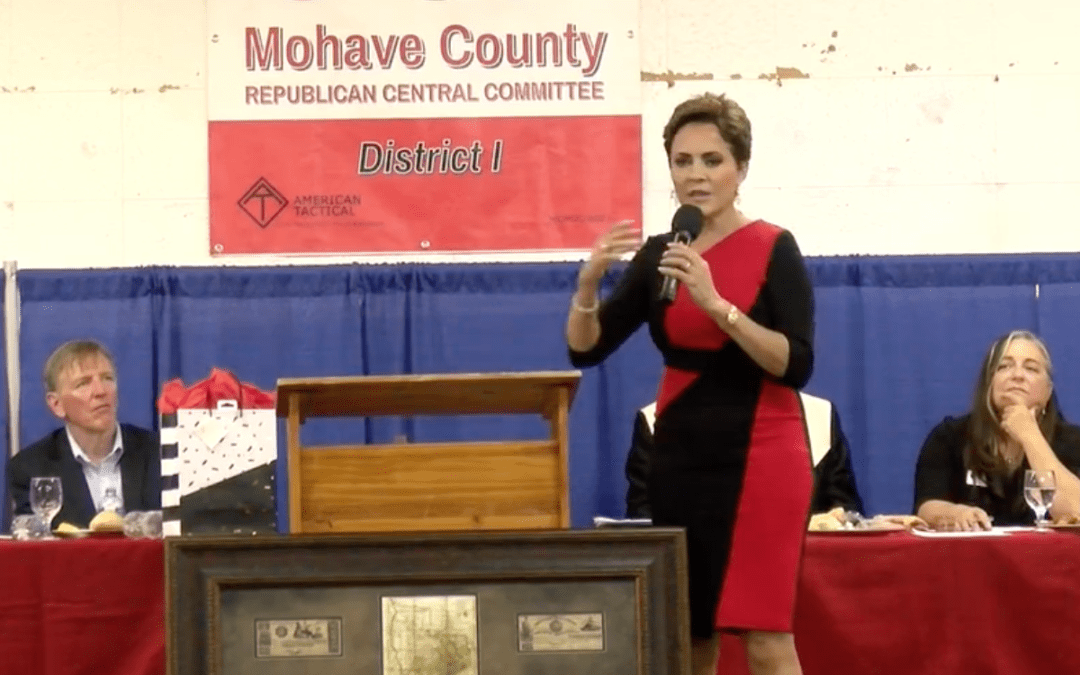

Kari Lake calls on Arizona county sheriffs to enforce 1864 abortion ban

Republican candidate for US Senate Kari Lake on Saturday seemed to solidify her support for Arizona’s total abortion ban and called on county...

Where to buy farm-fresh eggs in Tucson

Once you’ve tasted farm-fresh eggs, it’s hard to go back to the store-bought variety. Not only do farm-fresh eggs taste better and have...