Arizona Republicans recently gave the state’s wealthiest a major tax cut. Now, their national counterparts want to raise taxes for everyone else.

In Arizona and all across the country, Republicans are pushing to cut taxes for the rich—and raise taxes for everyone else.

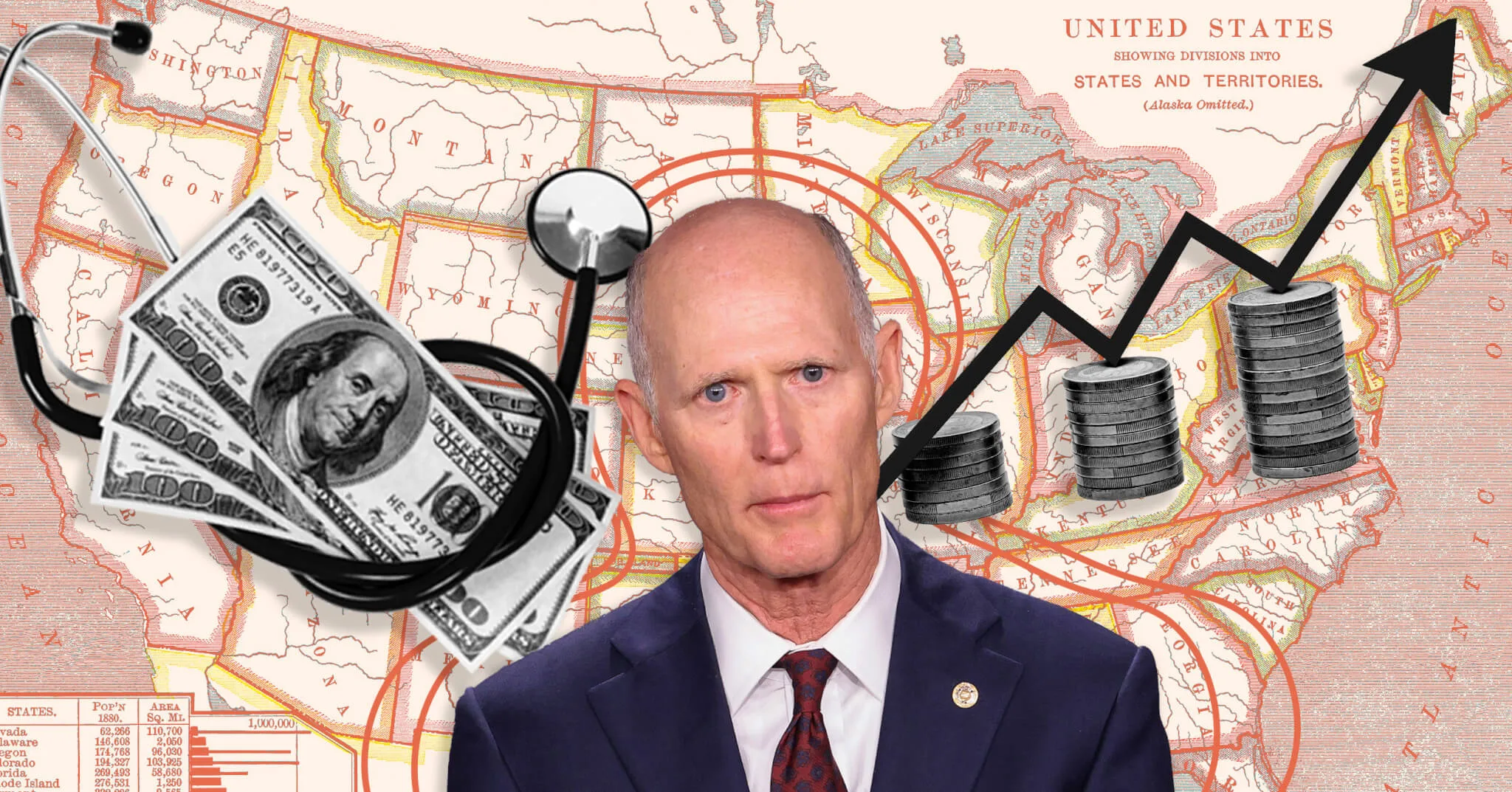

Did you know that the Republican senator in charge of winning back control of the Senate for his party introduced a plan to increase taxes on more than one-third of Arizonans and put Medicare, Medicaid, Social Security, and the Affordable Care Act in jeopardy?

If you answered ‘no,’ you’re not alone. According to a new Courier Newsroom/Data for Progress poll, 94% of likely voters said they have heard little or nothing at all about Florida Sen. Rick Scott’s 60-page plan to “Rescue America,” with 72% hearing nothing at all.

When voters learn about Scott’s plan though, they overwhelmingly oppose it, with 71% of respondents, including 62% of Republicans, opposing Scott’s plan. Only 15% of likely voters support the plan.

An Unpopular Approach

Similar tax plans pushed in Arizona have been similarly unpopular. A massive income tax cut approved by the Republican-controlled Legislature and Gov. Doug Ducey last year was met with considerable opposition from state residents, who collected over 200,000 signatures for a referendum on the newly-passed tax cuts.

If successful, the referendum would have required the tax proposal to be voted on in the 2022 election, giving voters the opportunity to approve or reject the cuts. But the Arizona Supreme Court ruled that the state’s voters do not have the right, effectively killing the measure.

“A true Democracy should have no problem allowing this to go before the voters of Arizona,” Arizona Senate Minority Leader, Sen. Rebecca Rios, D-Phoenix, said. . “Republicans continue to attack our schools, teachers and students, despite a majority of Arizonans making it clear time and time again that they want meaningful investments in our public schools.”

The court’s decision leaves the tax cut in effect. They are expected to cut state revenue by nearly $2 billion when it is fully in place and will mainly benefit the wealthy.

Killing the Social Safety Net

Such opposition is not exactly surprising, since the Republican’s plan would raise taxes on tens of millions of Americans and “sunset” all federal legislation in five years, requiring Congress to re-authorize every federal law, including those governing Medicare, Medicaid, and Social Security. This could create an opening for Republicans—who havelongsought to undermine the programs—to ultimately kill them.

If Scott’s plan were to become law, it could:

- End Social Security and Medicare for 1.4 million Arizonans

- End Medicaid coverage for 2.1 million state residents

- Raise taxes on 34% of Arizonans, according to the Institute on Taxation and Economic Policy

- Raise taxes on 55% of small businesses in the state, with the typical business paying an extra $1600 per year in taxes, according to a White House analysis.

Scott—who in 2018 was worth $260 million—has defended his plan, even as it could have potentially devastating consequences for seniors, families, and the most vulnerable Arizonans.

The survey of 1,110 likely voters, which was conducted from April 30 to May 3, 2022 also shows that the proposal from the Chairman of the National Republican Senatorial Committee—the “only national organization dedicated to taking back the Senate majority”—could be electoral poison for Republicans.

Forty-seven percent of independent voters said Scott’s plan would make them less likely to vote for Republican candidates for Congress in November, while only 12% said it would make them more likely to vote for him and 41% said it wouldn’t impact their choice.

Looking for the latest Arizona news? Sign up for our FREE daily newsletter.

Politics

Kari Lake calls on Arizona county sheriffs to enforce 1864 abortion ban

Republican candidate for US Senate Kari Lake on Saturday seemed to solidify her support for Arizona’s total abortion ban and called on county...

VIDEO: Arizona Rep. Greg Stanton ‘We will not stay silent’ on abortion ban

@coppercourier "Under this extreme law, women will die, and their doctors and nurses will be criminalized. This cannot stand," Rep. Greg...

Local News

6 terrifying things that could happen if the Comstock Act is used to target abortion

Does 1873 sound like a really, really long time ago? Well, that’s because it is—but if Republicans and far-right anti-abortion activists have their...

ASU football slapped with probation due to violations during Herm Edwards era

The violations described in the NCAA statement include impermissible in-person recruiting contacts while the state of college athletics was...