Last month Arizona families received their last installment of the expanded Child Tax Credit (CTC) made available through President Joe Biden’s American Rescue Plan.

This has been a lifeline for many families trying to find stability in the face of an ongoing pandemic. If Congress had successfully passed the Build Back Better Plan before Dec. 28, 2021, Arizona families would have received another CTC payment on Jan. 15.

Arizona families desperately need federal support in our continued fight against COVID-19. The national average for children under 18 who would benefit from the Child Tax Credit expansion is 89%. In Arizona, 92%of children would benefit.

Recent data from SaverLife, a nonprofit whose mission is to create economic prosperity for working families, indicates that if the enhancements to the CTC were made permanent, low- to moderate-income households would use the funds to invest in their families and their future.

Reducing Child Poverty

Families across our nation—especially in Arizona—are ready to invest in their future. The expanded CTC means a regular source of support for the families that need it most.

According to a recent report from the Center on Budget and Policy Priorities, making the CTC expansion permanent would reduce childhood poverty by 40%. In Arizona, estimates from the Arizona Center for Economic Progress suggest that over 70% of the total tax benefits from the CTC expansion will accrue to households making less than $70,000 per year.

RELATED: Advocates Praise Expanded Child Tax Credit for Helping Arizona Families Make Ends Meet

There are many important provisions in the Build Back Better Act that will make progress in our work to eliminate childhood poverty, giving children the strong foundation they truly need. For example, the expanded Child Tax Credit will help lift about 10 million children out of poverty.

Growing up in poverty, even for short periods of time, can cause long-term emotional, physical, and economic instability. Poorer children are at greater risk for negative life outcomes, such as lower academic achievement, abuse, behavioral problems, and developmental delays.

Extending the enhanced child tax credit through 2025—and making it permanently refundable—will allow families to pay for everyday expenses, like groceries and school supplies, as well as have the money needed for medical bills, childcare, and rent. This is something Congress should pass immediately.

Investing in the Future

Overwhelmingly, working families would have the opportunity to make long-term changes to build a base of financial security and to dream of a new life for their children, should Congress make the tax credit permanent. Specifically, a SaverLife poll showed that 71% of families would move to better housing, 74% of families would seek out better education for their children, and 57% would use the Child Tax Credit to begin investing in a college savings fund for their children.

The expanded CTC is an extremely effective way to reduce poverty, support economic growth in local economies, and help parents provide their families with the tools and resources for a strong start in life. The US House has passed the Build Back Better Act, and it is now the responsibility of the Senate to act quickly to pass the legislation.

A Once-in-a-Generation Opportunity

Families across Arizona are looking to Sen. Kyrsten Sinema for her support of the Build Back Better Act because the legislation will help improve health and economic outcomes for children and parents in our state.

Arizona’s senators must decide, are they going to support Build Back Better and make the CTC expansion permanent, or continue to reward the wealthiest 1% of Americans? Congress has a once-in-a-generation opportunity to help lift Arizona families out of poverty. It is imperative they act to make the CTC permanent. The futures of millions of children depend on it.

Looking for the latest Arizona news? Sign up for our FREE daily newsletter.

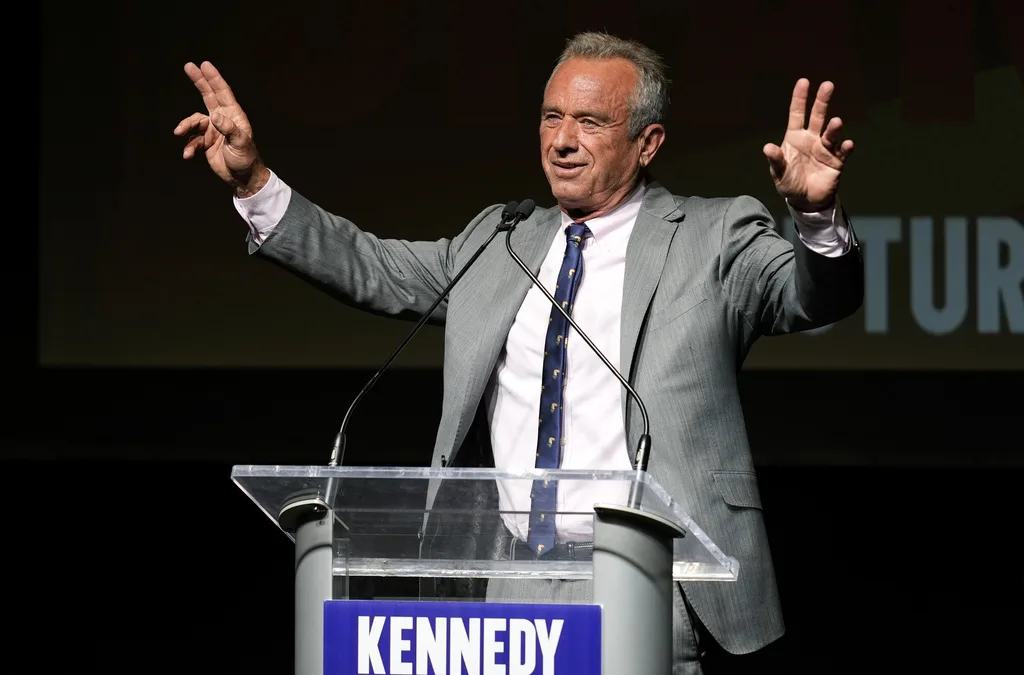

He said what? 10 things to know about RFK Jr.

The Kennedy family has long been considered “Democratic royalty.” But Robert F. Kennedy, Jr.—son of Robert F. Kennedy, who was assassinated while...

Here’s everything you need to know about this month’s Mercury retrograde

Does everything in your life feel a little more chaotic than usual? Or do you feel like misunderstandings are cropping up more frequently than they...

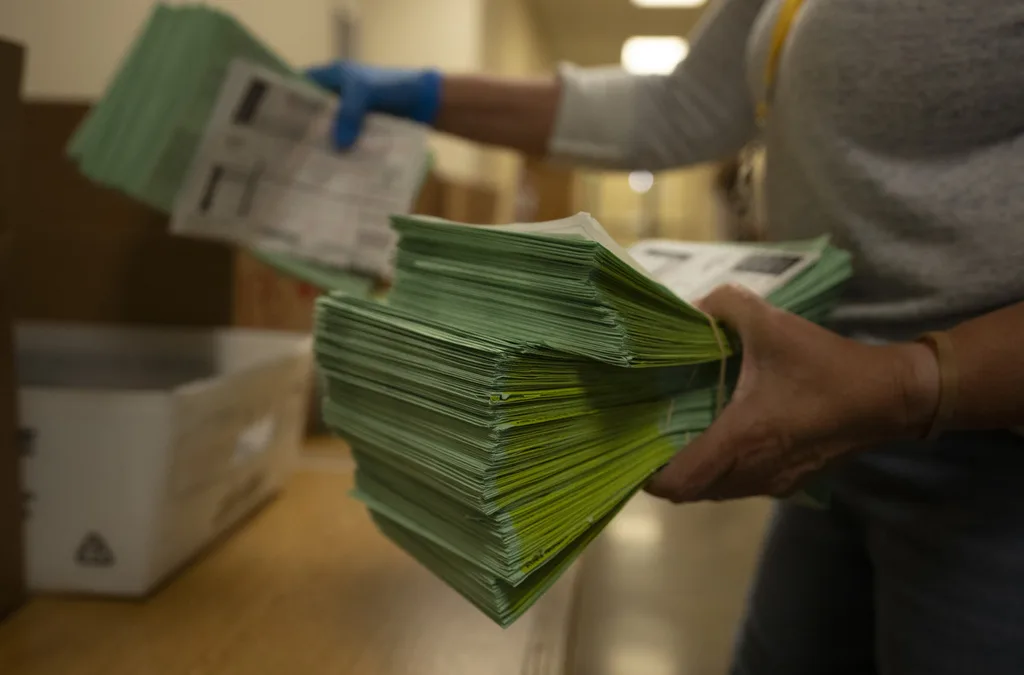

Arizona expects to be back at the center of election attacks. Its officials are going on offense

Republican Richer and Democrat Fontes are taking more aggressive steps than ever to rebuild trust with voters, knock down disinformation, and...

George Santos’ former treasurer running attack ads in Arizona with Dem-sounding PAC name

An unregistered, Republican-run political action committee from Texas with a deceptively Democratic name and ties to disgraced US Rep. George Santos...