US President Joe Biden announces student loan relief with Education Secretary Miguel Cardona (R) on August 24, 2022 in the Roosevelt Room of the White House in Washington, DC. - Biden announced that most US university graduates still trying to pay off student loans will get $10,000 of relief to address a decades-old headache of massive educational debt across the country. (Photo by OLIVIER DOULIERY / AFP) (Photo by OLIVIER DOULIERY/AFP via Getty Images)

In the past week, two separate courts controlled by conservative judges have ruled against the Biden administration’s plan to cancel tens of thousands of dollars in federal student loan debt for millions of borrowers, putting that relief in jeopardy.

Last week, a federal district court in Texas issued a ruling calling the plan “unconstitutional.” And addressing a separate lawsuit, the 8th Circuit Court of Appeals on Monday issued a nationwide injunction temporarily barring the relief program.

Biden’s plan, which he implemented via executive order in August, called for $10,000 in debt to be canceled for those who went to college and earned less than $125,000 (or $250,000 for a married couple) in 2020 or 2021. It also called for $20,000 in debt to be canceled if you went to college, received Pell Grants (a form of federal financial aid for undergraduate students), and met the income threshold. For borrowers who had less than $10,000 in debt left, the remaining balance would be wiped out. As part of his plan, he also extended the payment pause on federal student loans through the end of 2022.

In October, applications for student debt relief opened, and millions of borrowers applied for relief. Now, debt cancellation is on hold.

Two plaintiffs are involved in the Texas lawsuit, which is backed by the conservative organization Job Creators Network Foundation, and they allege that the cancellation plan “unfairly” excludes them and therefore should not be allowed. U.S. District Judge Mark Pittman — an appointee of former President Donald Trump — also ruled that the program seized Congress’ power to make laws.

The other lawsuit involves six states with Republican attorneys general: Nebraska, Missouri, Arkansas, Iowa, Kansas, and South Carolina. The suit claims that the debt cancellation would cost these states tax revenue by depriving them of student loan debt that they could impose taxes on in the future.

The ruling in this case came from a panel made up of three Republican appointees, one who was appointed by former President George W. Bush, and two who were appointed by Trump, according to the Associated Press.

Despite the legal setbacks, the Biden administration isn’t giving up on their plan. In a statement issued last Friday, Secretary of Education Miguel Cardona said that the administration strongly believes that the plan is “lawful and necessary to give borrowers and working families breathing room as they recover from the pandemic and to ensure they succeed when repayment restarts.” He also said that the Department of Justice has appealed the Texas ruling on the Biden administration’s behalf.

White House Press Secretary Karine Jean-Pierre has also said that the Biden administration is confident in its legal authority and will not stop fighting to “help working and middle-class Americans get back on their feet.”

According to Cardona, 26 million borrowers have provided the information needed to process their applications for relief, and 16 million applications have been approved and sent to loan servicers to be discharged when allowed by the courts.

Both the Texas case and the lawsuit filed by the six states, known as Nebraska v. Biden, are likely heading to the US Supreme Court. But before it reaches that level, both the 5th and 8th Circuit Courts of Appeals will have to rule separately in each case. Both of these courts are headed by conservative judges.

So, where does this leave borrowers?

While the Biden administration has insisted that it will prevail in either case, the millions of borrowers who are eligible for the program are spooked, as student loan payments are expected to begin again on Jan. 1, 2023. Because of this, the administration is facing pressure to extend the payment pause again until the legal challenges are worked out.

For now, the Biden administration is no longer accepting applications for student loan cancellation, and payments are set to resume in the new year.

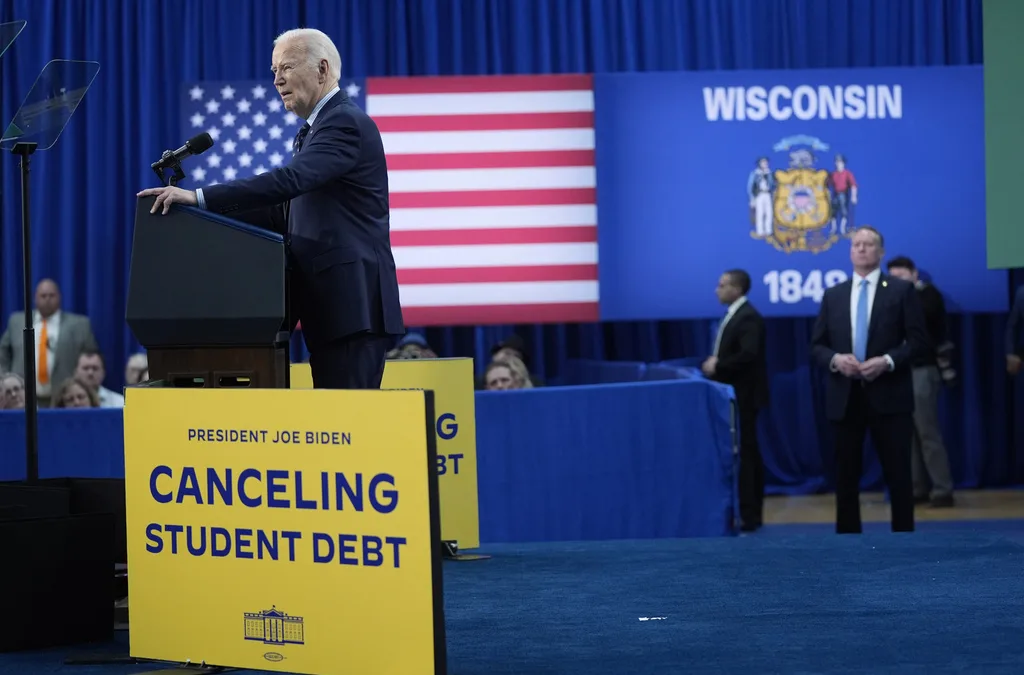

Biden unveils new plan for student debt relief

The Biden-Harris Administration on Monday unveiled new plans to relieve student debt for more than 30 million borrowers. During appearances across...

78,000 public service workers get student loans canceled by Biden administration

Through improvements to the public service Loan Forgiveness Program, the Biden administration has canceled loans for more than 871,000 public...

Navigating the new FAFSA? Here’s what you need to know.

Right now, kids and parents across the US are sitting down with calculators, hoping they'll be able to afford college this fall. And most of them...

Arizonans get relief as Biden cancels nearly $5 billion more in student debt

The Biden administration on Wednesday announced that it approved the cancellation of nearly $5 billion in additional federal student loan debt for...