FILE - President Joe Biden pauses as he speaks in the Roosevelt Room of the White House, Friday, June 30, 2023, in Washington. Education Secretary Miguel Cardona listens at left. After a series of major blows to his agenda from the Supreme Court, Biden is intent on making sure it is voters — not the justices of the high court — who have the final say. “Republicans snatched away the hope that they were given,” Biden said hours after the high court overturned his plan to forgive a majority of the country’s federal student loans. (AP Photo/Evan Vucci, File)

More than 800,000 Americans will get much-needed debt relief, after the Department of Education announced Friday that it would automatically cancel their student loans to account for past failures in the repayment system.

The action is part of the Biden Administration’s Income-Driven Repayment (IDR) Account Adjustment, which is aimed at “remedying decades of historical and structural failures to deliver loan relief for borrowers who have fallen through the cracks of the broken system,” according to the Student Borrower Protection Center. It’s expected to total $39 billion in federal student loan cancellation.

The Education Department said Friday that federal student loan borrowers are eligible for cancellation if they have been making payments on their debt for at least 20 years. For some, qualifying monthly payments that “should have moved borrowers closer to forgiveness were not accounted for,” effectively forcing them to make extra payments under their IDR plans.

“For far too long, borrowers fell through the cracks of a broken system that failed to keep accurate track of their progress towards forgiveness,” Education Secretary Miguel Cardona said in a statement. “By fixing past administrative failures, we are ensuring everyone gets the forgiveness they deserve.”

This move from the Biden administration is in direct response to the Supreme Court striking down the president’s plan to cancel up to $20,000 in debt for 43 million federal student loan borrowers in a 6-3 ruling in June.

Hours after SCOTUS delivered its ruling, President Biden said that his administration would begin exploring other options for relief. “Today’s decision has closed one path. Now we’re going to pursue another,” he said.

The president also said at the time that he was directing the Dept. of Education to come up with a new plan for widespread loan cancellation that would be grounded in the Higher Education Act, which governs the administration of federal higher education programs and provides financial assistance for students in higher education. But that kind of proposal would mean borrowers would have to wait longer for relief, Biden said.

Persis Yu, deputy executive director and managing counsel at the Student Borrower Protection Center called Friday’s announcement a “huge victory” for borrowers, but said that it was “only the tip of the iceberg.”

“We applaud the Biden administration for standing up for these borrowers who, until now, were left stranded at the whims of a cruel and broken system,” she said in a statement.

“But make no mistake—over 804,000 people are receiving relief with this action because of 804,000 failures,” she went on. “Working people with student loan debt have been made collateral damage by a dysfunctional student loan system. Just like we saw with Public Service Loan Forgiveness, our student loan system is riddled with structural incompetence, and vulnerable, low-income, and Black and brown borrowers face the harshest effects. Now, our leaders need to finish the job.”

Biden cancels student loan debt for 7,000 more Arizonans

The Biden administration on Friday announced its cancellation of an additional $7.4 billion in student debt for 277,000 borrowers, including 7,000...

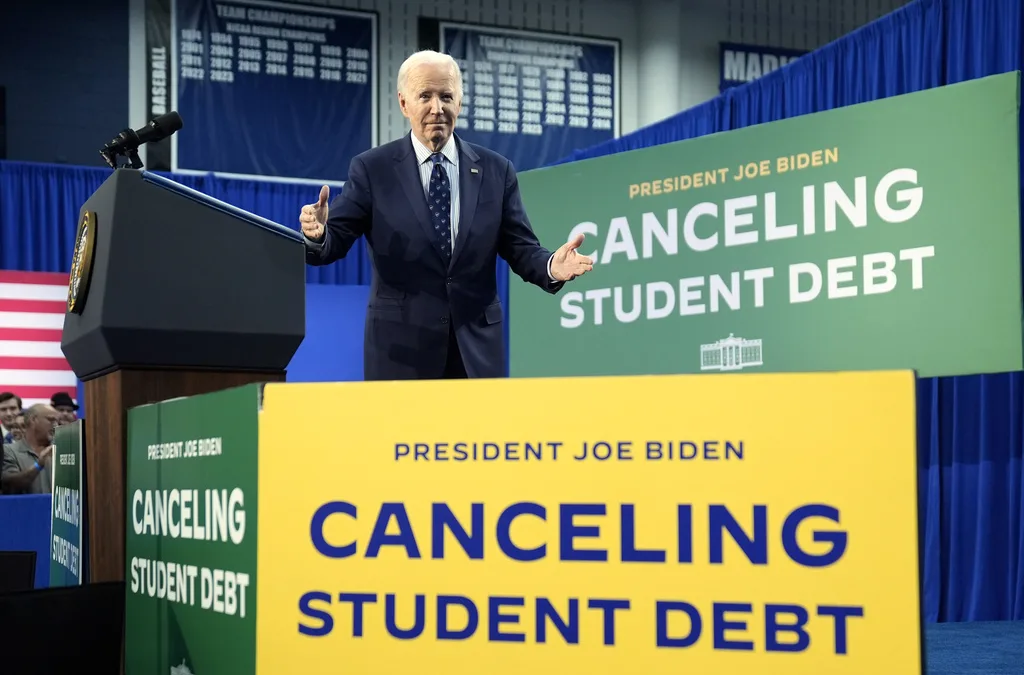

Biden unveils new plan for student debt relief

The Biden-Harris Administration on Monday unveiled new plans to relieve student debt for more than 30 million borrowers. During appearances across...

Biden proposes new student debt relief plan for Arizona borrowers facing ‘hardship’

The Biden administration on Thursday announced its latest proposal for widespread student loan cancellation that could provide relief to millions...

Navigating the new FAFSA? Here’s what you need to know.

Right now, kids and parents across the US are sitting down with calculators, hoping they'll be able to afford college this fall. And most of them...