AP Photo/Jacquelyn Martin

Through improvements to the public service Loan Forgiveness Program, the Biden administration has canceled loans for more than 871,000 public service workers.

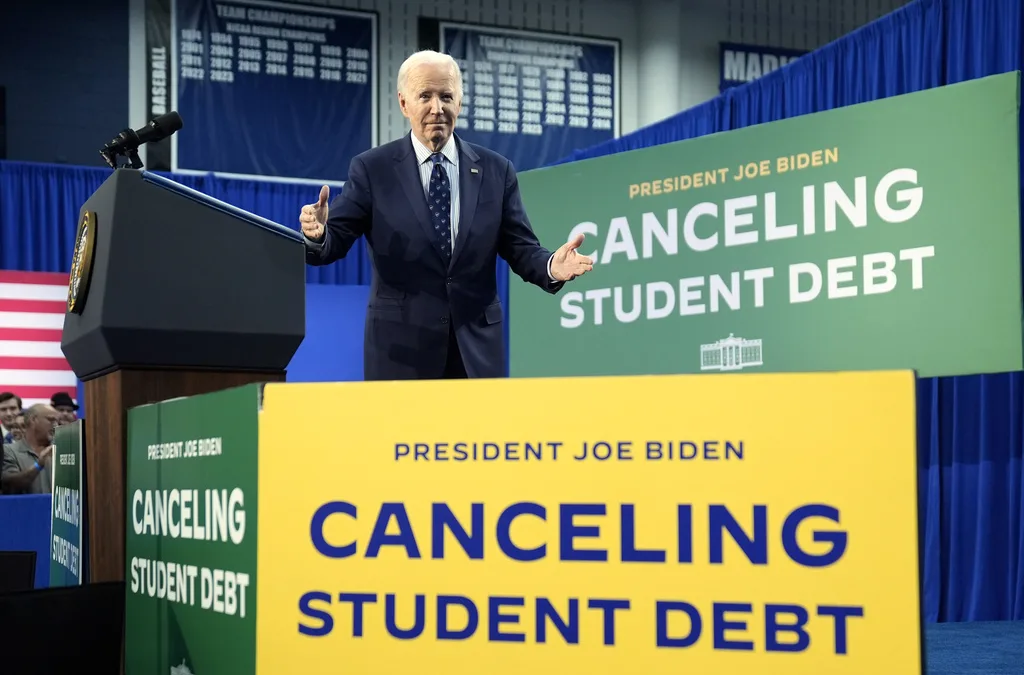

WASHINGTON (AP) — Another 78,000 Americans are getting their federal student loans canceled through a program that helps teachers, nurses, firefighters and other public servants, the Biden administration announced Thursday.

The Education Department is canceling the borrowers’ loans because they reached 10 years of payments while working in public service, making them eligible for relief under the Public Service Loan Forgiveness program.

“These public service workers have dedicated their careers to serving their communities, but because of past administrative failures, never got the relief they were entitled to under the law,” President Joe Biden said in a statement.

Congress created the program in 2007, but rigid rules and missteps by student loan servicers left many borrowers unable to get the cancellation they were promised. The Biden administration loosened some of the rules and retroactively gave many borrowers credit toward their 10 years of payments.

Through those actions, the Biden administration has canceled loans for more than 871,000 public service workers. Previously, about 7,000 borrowers had successfully gotten their loans canceled.

The latest round of forgiveness will cancel about $5.8 billion in federal student loans.

Starting next week, those receiving the forgiveness will get an email from Biden congratulating them on their relief. A message from the Democratic president, who’s running for reelection, will also be sent to 380,000 borrowers who are within two years of forgiveness under the program.

“I hope you continue the important work of serving your community,” the message says, “and if you do, in less than two years you could get your remaining student loans forgiven through Public Service Loan Forgiveness.”

The program was created to encourage Americans to work in public service, including teachers, firefighters, nurses, government employees and those who work for nonprofit groups. After 10 years of monthly payments on their loans, the program promised to erase the remainder.

But when the first wave of workers hit their 10-year mark, the vast majority were rejected. Many didn’t realize their loans weren’t eligible under the program’s rules, and many had been improperly steered into forbearance by their loan servicers, putting a temporary pause on payments and halting their progress toward cancellation.

In 2021, the Biden administration offered a one-time fix that retroactively gave borrowers credit for past payments even if they had been in forbearance or had an ineligible loan. It later loosened some of the rules permanently. Payments made more than 15 days after their due date previously weren’t counted toward the 10 years, for example, but the new rules count payments that are late or made in installments.

“Today, more than 100 times more borrowers are eligible for PSLF than there were at the beginning of the Administration,” Education Secretary Miguel Cardona said Thursday.

The Biden administration says it has now canceled nearly $144 billion in federal student loans through the public service program and others, including a program for borrowers who have been misled by their colleges.

Biden is separately pushing for wider cancellation for borrowers who have been making payments for decades and those who went to colleges that are deemed to have low value for graduates, among others.

The Education Department is pursuing that plan through a federal rulemaking process after the US Supreme Court blocked Biden’s previous attempt at widespread cancellation.

Biden cancels student loan debt for 7,000 more Arizonans

The Biden administration on Friday announced its cancellation of an additional $7.4 billion in student debt for 277,000 borrowers, including 7,000...

Biden unveils new plan for student debt relief

The Biden-Harris Administration on Monday unveiled new plans to relieve student debt for more than 30 million borrowers. During appearances across...

Navigating the new FAFSA? Here’s what you need to know.

Right now, kids and parents across the US are sitting down with calculators, hoping they'll be able to afford college this fall. And most of them...

Arizonans get relief as Biden cancels nearly $5 billion more in student debt

The Biden administration on Wednesday announced that it approved the cancellation of nearly $5 billion in additional federal student loan debt for...