FILE - President Donald Trump pumps his fist after speaking in the East Room of the White House, early Wednesday, Nov. 4, 2020, in Washington. Trump is already laying a sweeping set of policy goals should he win a second term as president. Priorities on the Republican's agenda include a mass deportation operation, a new Muslim ban and tariffs on all imported goods. (AP Photo/Evan Vucci, File)

In response to the report, the Harris-Walz campaign released an analysis of its own, outlining how Trump’s agenda would raise costs for over 2.9 million Arizona households by an average of $3,954 per year.

Republican presidential candidate Donald Trump’s tariff and tax proposals would increase taxes for 95% of Americans, according to a new analysis from The Institute on Taxation and Economic Policy (ITEP).

The former president’s proposed tariffs “would be largely passed onto consumers as increased prices,” according to the ITEP, which found that 80% of Americans would pay an average of $2,872 more per year as a result of Trump’s tariffs alone.

Trump has proposed a 20% tariff on all imported goods and a 60% tariff on Chinese imports. In recent days, he’s even discussed tariffs of up to 2,000% on foreign vehicles.

Trump’s tariff proposals would effectively impose a tax on American households, hurt businesses that rely on imports, cause job losses, and reduce other revenues due to their economic effects, according to the ITEP report.

Trump has argued his tariffs would raise several trillion dollars — which could happen in theory — but economic experts believe the economic costs would far outweigh any benefits.

“Tariffs on the scale that former President Trump has proposed would massively disrupt the economy,” the ITEP analysis states. “They would cause substantial price increases on imported goods, severely damage the industries that rely on imports, hurting employment in those industries, and result in price increases for goods for which final production occurs domestically.”

One area in particular where families could feel the pinch of Trump’s tariffs is the food sector. About 15% of the American food supply was imported last year, including 94% of seafood, 55% of fresh fruit, and 32% of fresh vegetables, according to the US Food and Drug Administration (FDA). If Trump were to impose tariffs on food products, it would reduce supply, causing prices to rise, while American grocery stores — and ultimately consumers — absorb the costs.

The overall cost of tariffs could be even higher than what ITEP estimates as well, according to other studies. The Yale Budget Lab released estimates this week projecting the annual cost could actually reach as high as $7,600 for an average American household.

Morgan Stanley economists also estimate that the implementation of these tariffs would mean 70,000 fewer jobs created each month in the US.

The ITEP analysis examined Trump’s tariff proposals, as well as his other tax plans, such as extending his soon-to-expire 2017 tax law, cutting corporate taxes from 21% to as low as 15%, exempting certain kinds of income (overtime pay, tips, and Social Security benefits) from taxes, and repealing clean energy tax credits enacted as part of the Inflation Reduction Act.

All told, Trump’s proposals would, on average, lead to a tax cut for the richest 5% of Americans and a tax increase for all other income groups. If these proposals are in effect in 2026, the richest 1%, or those with incomes of $914,900 per year and above, would receive an average tax cut of about $36,300.

The middle 20% of Americans, or those with incomes between $55,100 and $94,100 annually, would face an average tax increase of more than $1,500 per year. The poorest 20%, or those with incomes less than $28,600 per year, would face an average tax increase of about $800 annually.

In response to the report, the Harris-Walz campaign released a report of its own, outlining how Trump’s agenda would raise costs for over 2.9 million Arizona households by an average of $3,954 per year.

“Many of Trump’s proposals disproportionately benefit the well-off, like extending the 2017 tax changes and further cutting corporate taxes. Meanwhile his proposal for new broad-based tariffs would effectively raise taxes on everyone, with the greatest impact on working-class households,” Steve Wamhoff, Federal Policy Director for ITEP, said in a press release. “The net result of these proposals would allow the richest 5 percent of Americans to shift some of their taxes to everyone else.”

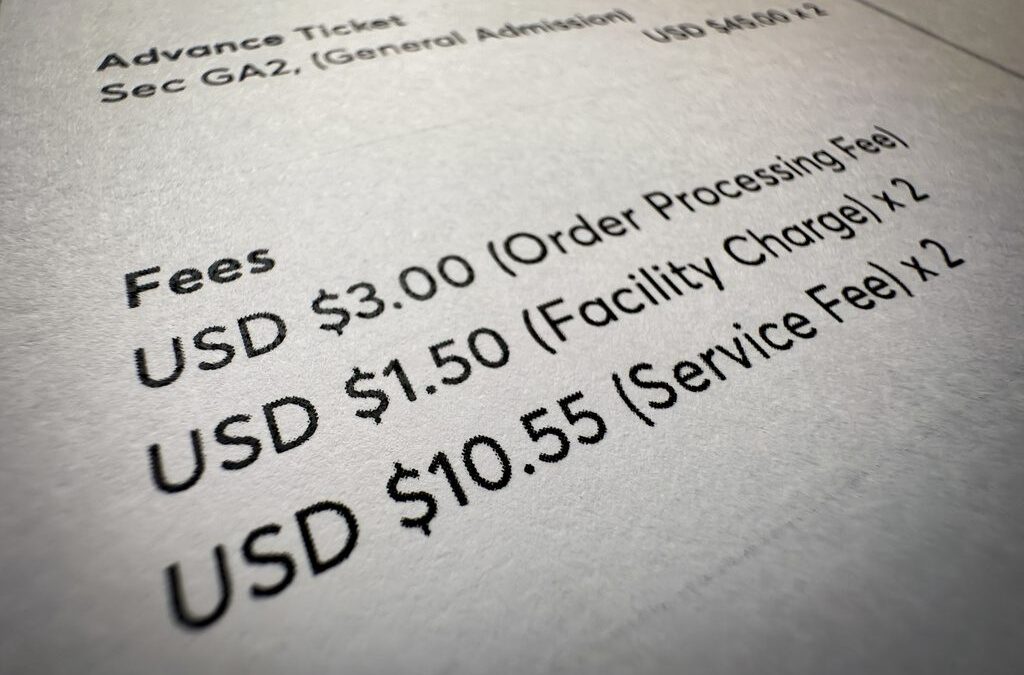

Sick of hidden fees on concert tickets and hotel stays? A new federal rule bans them.

Now, live event businesses and hotels must clearly list their prices in both their advertising and pricing information. American consumers on...

Trump’s tariff plan would raise prices and ‘reduce the living standard of Americans,’ economists say

Trump’s plan would effectively be a sales tax that disproportionately harms working-class families and could cause a trade war that hurts US...

Harris wants to give working families a tax cut and raise taxes on corporations. Trump would do the opposite.

Kamala Harris has proposed increasing the corporate tax rate, expanding the child tax credit, and cutting taxes for more than 100 million working...

Harris wants to cap child care costs and expand the child tax credit. Trump’s solution? Tariffs.

Harris has proposed capping families’ child care costs to 7% of their income and offering families of newborns up to $6,000 in the first year of the...