Arizona is near the bottom nationally in the amount of money it spends on schools.

PHOENIX (AP) — The Arizona Supreme Court on Thursday allowed a new tax on high earners approved by the state’s voters in November to remain in effect while a lower court determines if the revenue it raises for schools will exceed a constitutional spending limit.

The ruling from the high court was a major win for education proponents but it may only be brief. The ruling said if the lower court decides that the spending limit is exceeded, it must declare Proposition 208 unconstitutional and void it entirely. A dissenting opinion from one justice said the framework the court imposed to analyze the spending limit “almost certainly” dooms the measure.

The court rejected opponent’s arguments that Proposition 208 required a 2/3 vote to be enacted as required for tax increases imposed by the Legislature. But the court said it can’t yet tell whether the money it raises can be legally spent so it sent the case back to the lower court.

The Supreme Court threw a version of the initiative off the ballot in 2018 after ruling it was poorly written, but backers came back with a revised version last year, winning a slim voter approval.

Proposition 208 was expected to raise more than $800 million per year for K-12 schools by boosting income taxes on high-earning Arizona residents.

The challenge was filed by Republican legislative leaders and business groups, who argue the new tax would damage the economy by discouraging the wealthy from living or investing in the state. Republican Gov. Doug Ducey also is fiercely opposed and has said he hopes the Supreme Court finds it unconstitutional. Ducey has appointed five of the court’s seven members.

RELATED: Arizona Supreme Court Questions Legality of Voter-Approved Tax That Would Give Millions to Schools

The Legislature gutted parts of the tax in the session that ended in June, but backers of the Invest in Education Act are collecting signatures to block the new tax cuts and asking voters to repeal them.

The court was focused on the spending limit during oral arguments in April. Justice Bill Montgomery noted that about $600 million of the new cash might not be able to be spent if the court finds it was not legal for an exemption in the initiative to dole out the money as grants.

Thursday’s ruling did just that.

Proponents argued that distributing the money through grants to schools is often used to avoid triggering the spending limit. They also plan to argue in the lower court that the spending limit is now set artificially low and that resetting it to its proper place will allow all of the initiative’s new tax to be spent even if the grant provision is found to be unconstitutional.

Proposition 208 imposes a 3.5% tax surcharge on income above $250,000 for individuals or above $500,000 for couples. The Legislature’s budget analysts estimated it would bring in $836 million a year.

But the Legislature enacted a new tax category that would exempt small business income now taxed on personal returns from the Proposition 208 tax. If that stands, it will cut about $292 million from the new tax revenue schools would get under the initiative.

The measure was an outgrowth of a 2018 teacher strike that resulted in educators getting a 20% pay raise over three years. But the state did not meet their other demands, including that the Legislature boost other school spending and enact no more tax cuts until Arizona’s per-student school spending reaches the national average.

The state is near the bottom nationally in the amount of money it spends on schools.

RELATED: Arizona Lawmaker Says Voter-Approved Tax to Fund Education Is ‘Mob Rule’

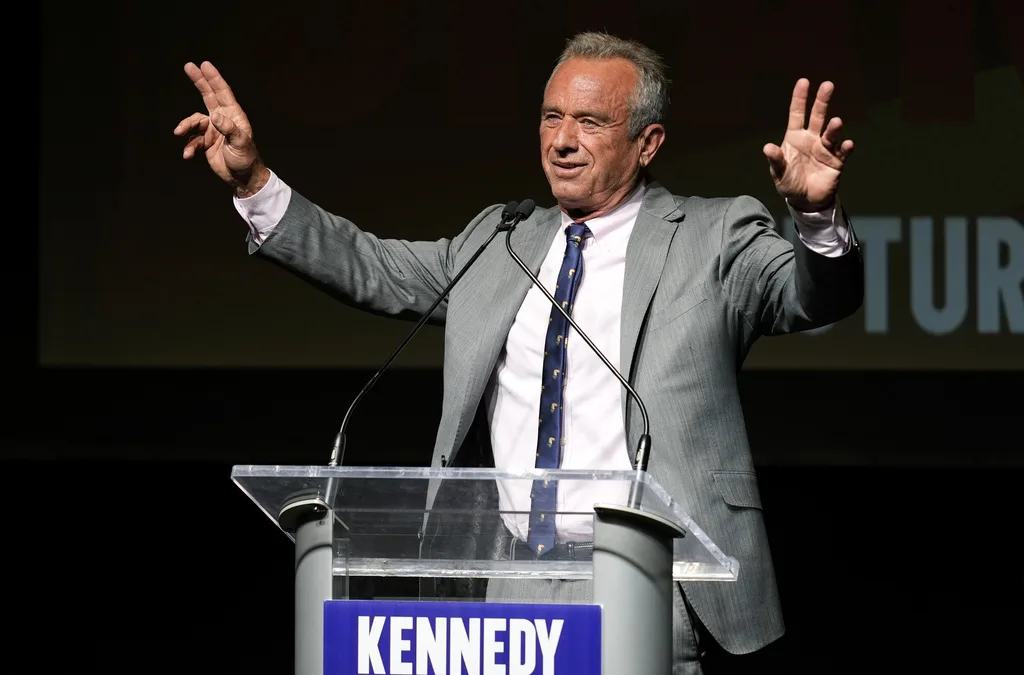

He said what? 10 things to know about RFK Jr.

The Kennedy family has long been considered “Democratic royalty.” But Robert F. Kennedy, Jr.—son of Robert F. Kennedy, who was assassinated while...

Here’s everything you need to know about this month’s Mercury retrograde

Does everything in your life feel a little more chaotic than usual? Or do you feel like misunderstandings are cropping up more frequently than they...

Arizona expects to be back at the center of election attacks. Its officials are going on offense

Republican Richer and Democrat Fontes are taking more aggressive steps than ever to rebuild trust with voters, knock down disinformation, and...

George Santos’ former treasurer running attack ads in Arizona with Dem-sounding PAC name

An unregistered, Republican-run political action committee from Texas with a deceptively Democratic name and ties to disgraced US Rep. George Santos...