AP Photo/Jacquelyn Martin, File

In a victory for student loan borrowers, the Biden administration last week announced a new path through which they can attempt to clear their debt via bankruptcy.

The Justice Department and Department of Education made the announcement as the Biden administration faces a number of legal challenges to its broader plan to cancel thousands of dollars of debt for millions of borrowers.

Prior to this move, student loan debt—unlike credit card bills, medical bills, and most other forms of debt—was not eligible to be automatically wiped away when a person filed for bankruptcy. Instead, a borrower would have to file a separate lawsuit in order to try to erase their debt and prove they were suffering from “undue hardship,” a process that was notoriously difficult and time consuming.

“The current undue hardship method of student loan discharge is random, arbitrary and unfair,” National Consumer Law Center (NCLC) Staff Attorney John Rao said in a statement. “Even though a borrower is in such desperate financial circumstances as to need to file bankruptcy, the government would typically argue that the borrower is not suffering ‘undue hardship’–a requirement for discharging student loans.”

Rao argues that the existing process was based on the flawed idea that borrowers would abuse the bankruptcy system, a faulty assumption that “exacerbated the problem” of student loan debt.

Under the new guidelines, borrowers can fill out an “attestation form,” which the Justice Department will then use to determine whether to recommend that borrower’s debt be fully or partially discharged into bankruptcy. These borrowers will have to meet certain criteria, such as having expenses that exceed their incomes and being of retirement age or having been in repayment for at least 10 years, for example.

The federal government will also consider whether the borrower has made a “good-faith effort” to earn income and pay back the loans. Bankruptcy judges will still make the final decision of whether to grant a discharge, but the new process establishes clear standards for recommending discharge to the judge “without unnecessarily burdensome and time-consuming investigations,” according to the Justice Department.

This decision was more than a year in the making. In Oct. 2021, the Justice and Education Departments announced that they were working to review their approach to student loan debt. Secretary of Education Miguel Cardona also said this past March that the Education Department had asked the Justice Department to pause any active bankruptcy cases if a borrower so wished.

In a statement, Associate Attorney General Vanita Gupta said that this new approach “outlines a better, fairer, more transparent process for student loan borrowers in bankruptcy,” and “will allow Justice Department attorneys to more easily identify cases in which” they “can recommend discharge of a borrower’s student loans.”

The New York Times notes that borrower advocates, consumer bankruptcy lawyers, and law professors are “cautiously optimistic” about the policy changes. Rao believes that the effectiveness of these changes will be determined by how they are implemented by the two departments.

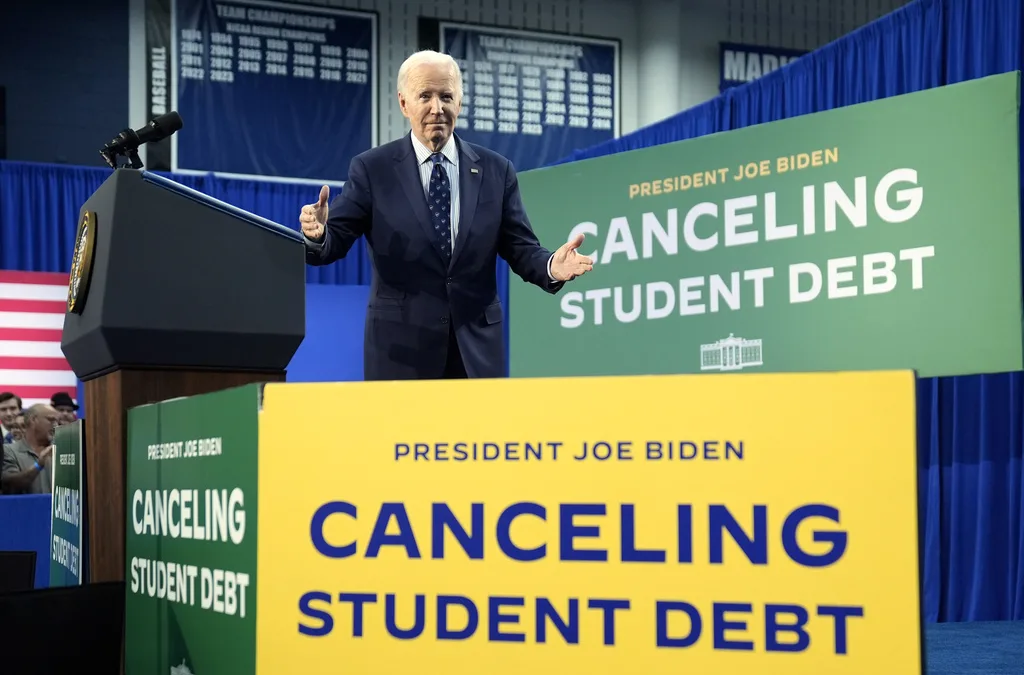

Biden cancels student loan debt for 7,000 more Arizonans

The Biden administration on Friday announced its cancellation of an additional $7.4 billion in student debt for 277,000 borrowers, including 7,000...

Biden unveils new plan for student debt relief

The Biden-Harris Administration on Monday unveiled new plans to relieve student debt for more than 30 million borrowers. During appearances across...

Biden proposes new student debt relief plan for Arizona borrowers facing ‘hardship’

The Biden administration on Thursday announced its latest proposal for widespread student loan cancellation that could provide relief to millions...

Navigating the new FAFSA? Here’s what you need to know.

Right now, kids and parents across the US are sitting down with calculators, hoping they'll be able to afford college this fall. And most of them...