(Shutterstock Photo/Africa Studio)

Seven companies have partnered with the IRS for its free file program.

Most Americans can file their taxes for free, but no-cost filing sites aren’t always well-known.

Companies like TurboTax and H&R Block advertise a free filing option, but that typically only applies to a basic tax return—anything more will trigger the company’s paid option.

Both companies left the IRS’ free file program during the COVID-19 pandemic.

RELATED: Do You Have Insurance Through Medicaid in Arizona? You Might Want to Read This.

Every American can file their taxes on their own for free, but only Americans who made $73,000 or less in the fiscal year qualify for the Internal Revenue Services’ guided tax preparation.

Seven companies have partnered with the IRS for its free file program. Here’s everything you need to know to file, from income and age limits to eligible states:

Sites Offering Free Federal and State Filing for Arizonans

- Income: $60,000 or less

- Age: 57 or younger

- Federal Filing: All states

- State Filing: Only free in 23 states, including Arizona

- Income: Between $11,100 and $73,000

- Age: All ages

- Federal Filing: All states

- State Filing: All states

- Income: $46,000 or less

- Age: All ages

- Federal Filing: All states

- State Filing: All states

Sites That Offer Free Federal Filing, But Not State Filing in Arizona

1040NOW Online Tax Preparation

- Income: $65,000 or less

- Age: All ages

- Federal Filing: Free in all states EXCEPT AK, FL, IN, NH, NV, TX, WA, and WY

- State Filing: No free state filing

- Income: $73,000 or less

- Age: All ages

- Federal Filing: Only free in 23 states, including Arizona

- State Filing: No free state filing

- Income: Between $3,000 and $73,000

- Age: 66 or younger

- Federal Filing: All states

- State Filing: Only free in Iowa, Idaho, North Dakota, and Vermont

- Income: $73,000 or less

- Age: Between ages 20 and 64

- Federal Filing: All states

- State Filing: Only free in AR, IA, ID, MS, MT, ND, RI, VT, WA, and WV

According to the IRS, all you need to file your taxes for free with these sites are your income statements like W2s or 1099s, adjustments to income, dependent and spouse information, and last year’s adjusted gross income.

Volunteer Income Tax Assistance (VITA)

If you make $60,000 or less, you are generally able get your taxes filed with the assistance of a certified IRS tax volunteer.

Many, but not all, locations require an appointment. Some appointments are drop-off, which means a volunteer makes a copy of all your tax information and schedules another appointment for you to pick up your prepared tax forms.

In-person appointments require you to stay at the site while your taxes are prepared. Tax documents need to be brought physically and can’t be downloaded or sent electronically.

The IRS has a tool to locate the VITA location closest to you.

Looking for the latest Arizona news? Sign up for our FREE daily newsletter.

Politics

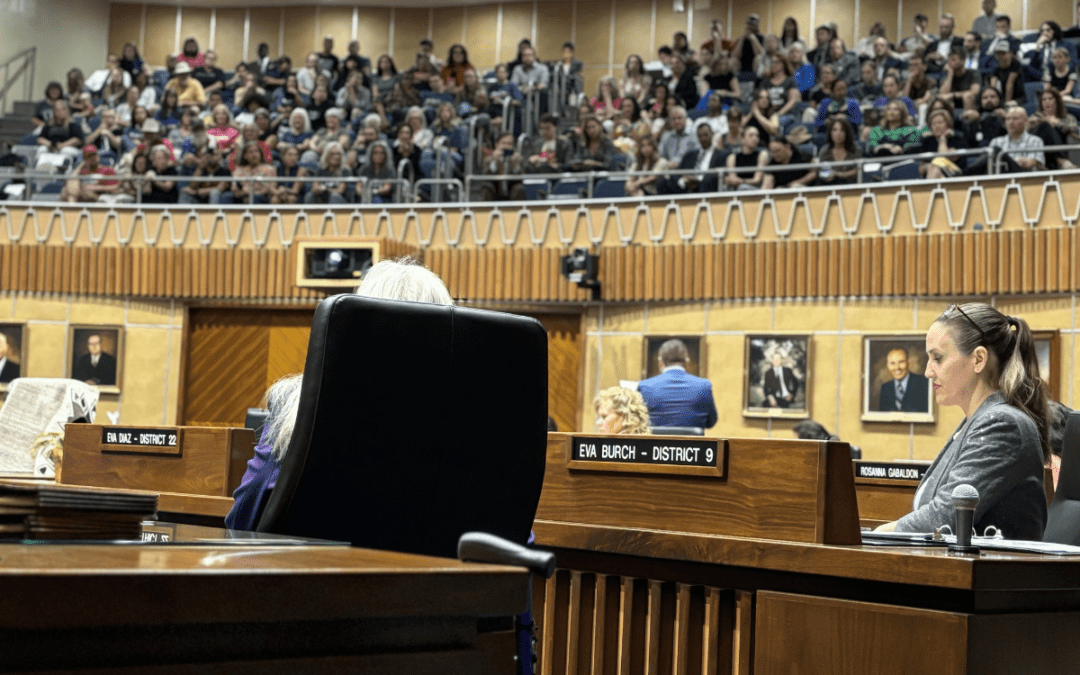

Democrats successfully force vote on repealing 1864 abortion ban, passes House

The Arizona legislature moved forward two bills Wednesday that would repeal the state’s 1864 abortion ban. A bill to repeal the ban has been...

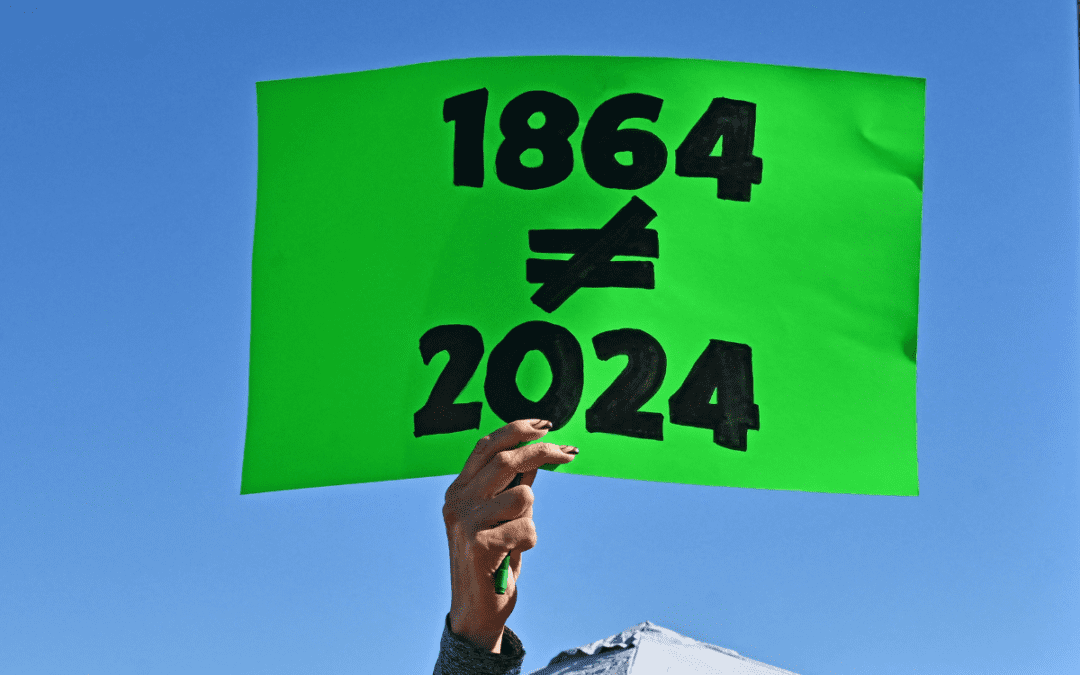

State Official: 1864 abortion ban gives Arizona ‘black eye’

Arizona’s role at the forefront of the climate crisis, defending democratic elections, and protecting reproductive rights has caught the attention...

Local News

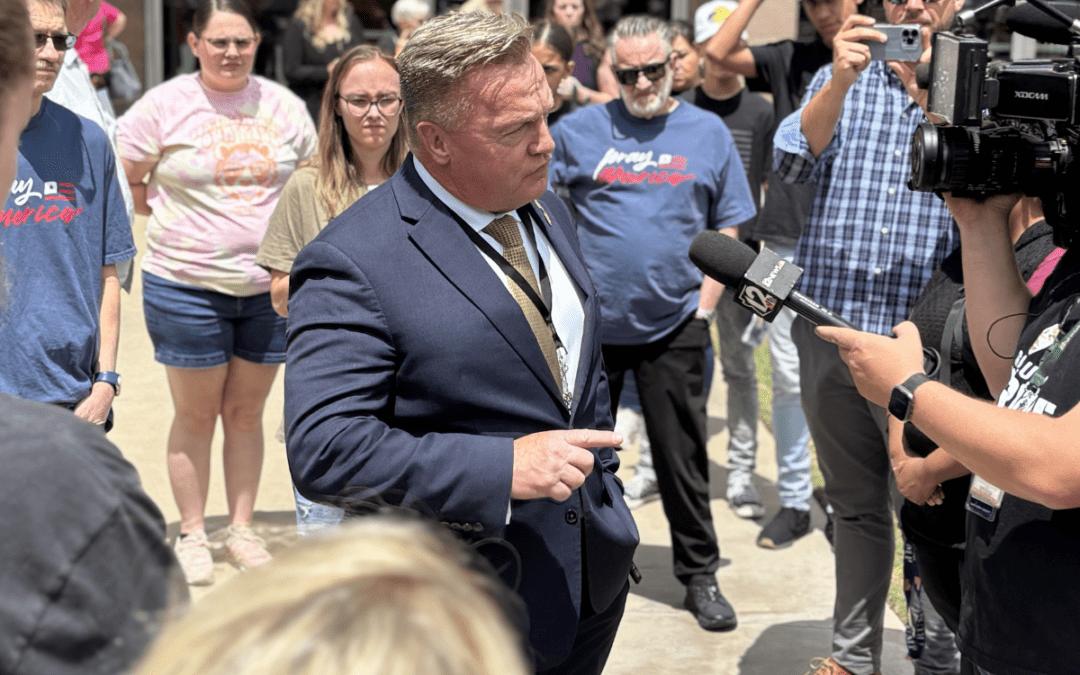

Arizona Sens. Anthony Kern, Jake Hoffman, indicted for fake election scheme

Eighteen individuals involved in a conspiracy to overturn Arizona’s election results in 2020 were indicted by a grand jury Wednesday and charged...

Gov. Gavin Newsom wants to let Arizona doctors provide abortions in California

California law generally allows abortion up to the point of fetal viability, which is around 24 weeks. SACRAMENTO, Calif. (AP) — Arizona doctors...