Shutterstock Image/zimmytws

43 million Americans will be back on the hook for student loan payments in less than two months unless Biden takes action.

Earlier this month, White House Chief of Staff Ron Klain hinted that President Joe Biden may soon take action on the nation’s $1.7 trillion in student loan debt. Biden has several options at his disposal to aid the nation’s 43 million student loan borrowers, experts told the American Independent Foundation.

“The president is going to look at what we should do on student debt before the pause expires, or he’ll extend the pause,” Klain said on the podcast Pod Save America episode released March 3.

“Right now, people aren’t having to pay on their loans, and so I think dealing with the executive branch question, what we should do about that, what his powers are, how much we should do on that, that’s something we’re going to deal with later on,” Klain added.

The freeze on student loan payments, which has been in place since March 2020, expires on May 1. There’s been a growing chorus from progressives calling for cancellation before then, urging Biden to fulfill his campaign promise of forgiving up to $10,000 in debt per borrower or to go even further and wipe out the nation’s federal student loan debt entirely.

But does Biden have the unilateral and legal authority to simply extinguish $1.7 trillion in debt with the flick of a pen? While some experts aren’t convinced, a growing coalition of academics, politicians, and advocates are arguing it is fully within Biden’s executive authority and would not require an act of Congress to give relief to millions of Americans struggling with student loan debt.

Last month, John King Jr., President Barack Obama’s former Secretary of Education, wrote an opinion column calling on the Biden administration to cancel student loan debt. King is the first current or former Secretary of Education to stake out this position.

“The president should use the tools that are available to him. In this case, through executive authority, he can act unilaterally on student debt,” King told the American Independent Foundation.

The Biden administration tasked the Department of Education with drafting a memo to look into the legal authority of the executive branch on the issue, which an activist group obtained last April through a Freedom of Information Act request. Progressives have called for the memo to be released publicly, as it was heavily redacted.

The dominant legal argument for cancellation centers on the Higher Education Act, which Congress passed in 1965. The act grants the Secretary of Education to “enforce, pay, compromise, waive, or release any right, title, claim, lien, or demand, however acquired, including any equity or any right of redemption.”

Legal experts call this the “compromise and settlement” authority and argue it gives Education Secretary Miguel Cardona, the ability to simply not collect on the nation’s federal student loan debts.

It’s an authority in use at this very moment. Former President Donald Trump invoked that ability when he put the payment moratorium in place at the beginning of the pandemic.

Some say there are limits to the scope of that authority. Harvard Law Professor Howell E. Jackson argues “it’s the plenary authority that’s complicated” or the unconditional ability to forgive billions of dollars without any sort of constraints.

But Cody Hounanian, Executive Director of the Student Debt Crisis Center, refutes that assertion by pointing to the text of the Higher Education Act.

“Nowhere in the law itself does it discuss any limitation to using this authority, and so I think there is a gap there as far as interpretation, and you can be very creative in your legal gymnastics when you go to interpret these types of things, but I don’t think it’s that credible,” Hounanian said.

He’s backed by attorneys at the Legal Services Center of Harvard Law School. In 2020, they wrote a memo to bolster a plan proposed by Sen. Elizabeth Warren (D-MA) during her presidential campaign to cancel up to $50,000 in debt for almost all student loan borrowers.

They concluded that her proposal called “for a lawful and permissible exercise of the Secretary’s authority under existing law.”

Another common argument against canceling student loan debt is the idea that Congress should maintain the sole power to appropriate funds.

“Only Congress has the power of the purse,” Mark Kantrowitz, a financial aid expert and author, told the American Independent Foundation. “And the people who believe that the president has authority are looking at trying to squeeze it into an interpretation of the waiver authority that just doesn’t exist.”

RELATED: Student Loan Debt Is Ruining Lives. Can We Just Cancel It?

However, this argument misunderstands how the U.S. government issues student loans, according to Hounanian. While Congress may have appropriated the funds in the first place, modifying the funds does not count as a separate appropriation, he argued.

Debt cancelation advocates have argued that while student loans are appropriations — and thus require congressional authorization — student loan cancellation requires no separate outlay and is authorized under the original appropriation.

“Congress appropriates the funds to the Department of Education for them to issue student loans to individuals, so the money’s already out the door,” he said. “The canceling of the student loan debt would be an act of administrative action where the federal government would just not collect on this debt. It’s not an act of spending, it doesn’t require appropriations. The government doesn’t write a check to themselves to pay off people’s student loans. They’re just not collecting on it.”

Others have argued that canceling student debt might violate the Antideficiency Act, which bars government employees from using more funds than they’ve received to spend. But legal experts told the American Independent Foundation that that is not a credible argument for the same reasons, as the Secretary is not spending any new money, but simply choosing not to collect on a loan.

Wiping out millions of dollars in student loan debt with the flick of a pen is not the only option experts have put forth. Even Jackson, who is skeptical of the White House’s authority to cancel student loan debt, still thinks “the administration has a lot of latitude” to take action.

Jackson said he supports loan forgiveness through negotiated rulemaking, where the Department of Education would propose new changes to administrative rules, seek public comments, and eventually publish new rules in the Federal Register. Through this process, Jackson said, the department could add in language around equitable considerations for loan forgiveness so that cancellation could target low-income borrowers.

Of course, the option always exists for Congress to take up the issue and wipe out debt by passing a piece of legislation, though experts said that prospect is virtually impossible with such narrow Democratic control of the Senate.

Regardless of what Biden chooses, voices from across the political spectrum argue that the crisis is growing more and more untenable and that Biden must do something to aid student loan borrowers.

Mark T. Williams, a financial expert who was a member of Biden’s economic advisory committee and teaches at Boston University, said this problem is “not going away” for millions of Americans.

“It’s not uncommon for graduates today to spend 20% to 25% of their salary just to pay down debt,” Williams told the American Independent Foundation. “Either you address it now or you’re going to see bankruptcies.”

Published with permission of The American Independent Foundation.

Looking for the latest Arizona news? Sign up for our FREE daily newsletter.

Politics

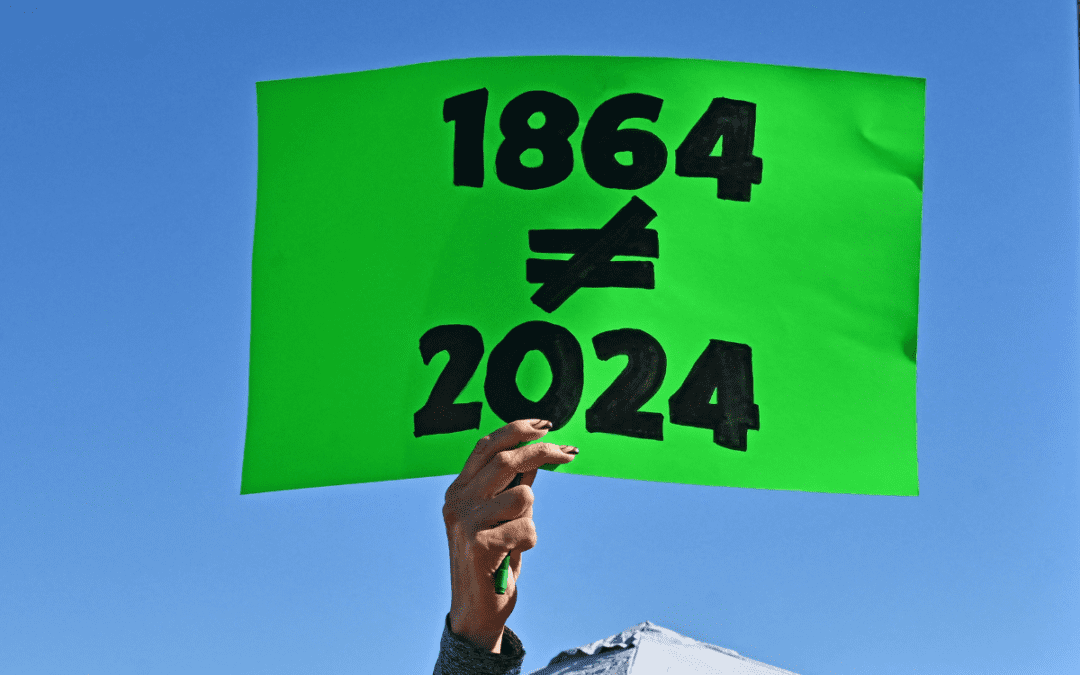

Democrats successfully force vote on repealing 1864 abortion ban, passes House

The Arizona legislature moved forward two bills Wednesday that would repeal the state’s 1864 abortion ban. A bill to repeal the ban has been...

State Official: 1864 abortion ban gives Arizona ‘black eye’

Arizona’s role at the forefront of the climate crisis, defending democratic elections, and protecting reproductive rights has caught the attention...

Local News

Arizona Sens. Anthony Kern, Jake Hoffman, indicted for fake election scheme

Eighteen individuals involved in a conspiracy to overturn Arizona’s election results in 2020 were indicted by a grand jury Wednesday and charged...

Gov. Gavin Newsom wants to let Arizona doctors provide abortions in California

California law generally allows abortion up to the point of fetal viability, which is around 24 weeks. SACRAMENTO, Calif. (AP) — Arizona doctors...