On Friday, #StockMarketCrash2020 was one of the top three trending topics on Twitter.

If you have money in the stock market, you’ve probably had a pretty rough week.

Amidst rising fears that the coronavirus outbreak could become a full-fledged pandemic, global markets are suffering their worst week since the 2008 financial crisis.

In the United States, the Dow Jones industrial average fell another 1,000 points on Friday before rebounding mid-day. But the index is still down by nearly 13% over the past seven days. The Nasdaq is down by more than 11% over that span, while the S&P 500 index has plunged by more than 12%.

European and Asian markets have also experienced sell-offs, as investors are growing increasingly concerned by the continued spread of coronavirus and have begun dumping their money into gold and government bonds, which are considered to be safer bets. Oil prices have also dropped this week, reflecting lower demand as the outbreak hampers factory production and reduces transportation.

Only about 55% of Americans own stocks, so the impact of the week’s crash has not been felt by many, but if the outbreak gets worse and the panic continues, ordinary Americans could soon find themselves paying more for basic goods as delays to the manufacturing supply chain reduce supply.

As of Friday morning, the coronavirus outbreak has sickened more than 83,700 people and killed at least 2,858 across 51 countries. While all but 70 of the deaths have come in mainland China, that number doubled this week as the number of cases surged in countries like Iran, Italy, and South Korea.

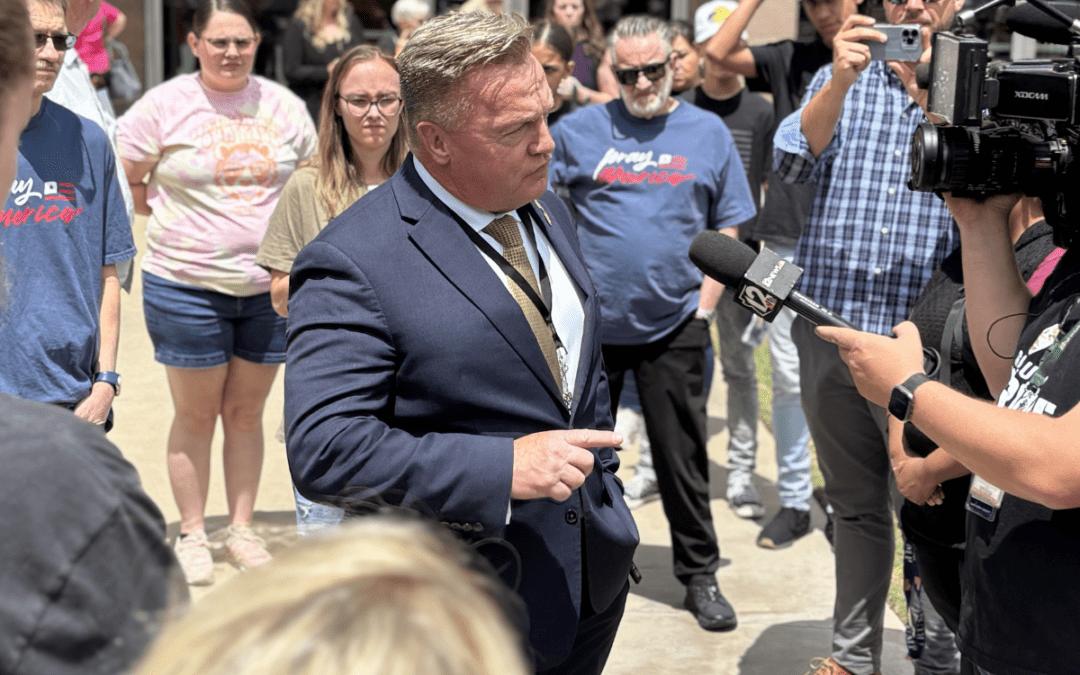

Larry Kudlow, the director of the White House’s National Economic Council and former CNBC commentator, tried to reassure panicked investors during an interview with the Fox Business Network on Friday. “I don’t think people should panic,” Kudlow said.

He also said the economy was “fundamentally sound” and that the White House believes the risk of something “very bad happening” in the U.S. was low. He even advised investors to consider buying stocks.

“It looks like the market’s gone too far,” he said. “Stocks look pretty cheap to me.”

Kudlow also held a press conference on Friday morning to try and further contain the damage to the stock market.

“We’ve been through this many, many times before,” Kudlow said. “I just don’t think at this point it’s going to have much of an impact.”

The numbers tell a different story. The week’s sell-off has already wiped out two years of gains on the Dow Jones and S&P 500 indexes.

In response to the week’s turmoil, Federal Reserve officials signaled on Friday that they might cut interest rates if the outbreak worsens.

“Further policy rate cuts are a possibility if a global pandemic actually develops with health effects approaching the scale of ordinary influenza, but this is not the baseline case at this time,” said James Bullard, president of the Federal Reserve Bank of St. Louis, in prepared remarks on Friday.

Such rate cuts could increase demand and lessen consumer and investor fear, but they will do little to resume factory production and fix supply chain problems. Dozens of companies, including Apple, Microsoft, and Ralph Lauren have said these problems will affect their sales, while the decrease in travel is affecting airlines, credit card companies, and cruise lines. Fears over a possible pandemic could also lead people to stop going out, hurting individual businesses, such as restaurants, movie theaters, and retail stores.

The CDC announced this week that it was all but certain that coronavirus would continue to spread in the United States.

“It’s not so much of a question of if this will happen anymore but rather more of a question of exactly when this will happen and how many people in this country will have severe illness,” Dr. Nancy Messonnier, director of the National Center for Immunization and Respiratory Diseases, said during a Wednesday briefing.

Should that occur, companies like Goldman Sachs and experts like former Fed chair Janet Yellen have warned that the outbreak could throw the American economy into recession.

Americans appeared to be anticipating such a downturn on Friday, as they made #StockMarketCrash2020 one of the top three trending topics on Twitter.

Politics

VIDEO: Everything you need to know about the Arizona abortion ban repeal

@coppercourier Here’s everything you need to know about when it begins, the push to repeal it, and what that means for the @arizonaforabortionaccess...

Arizona Sens. Anthony Kern, Jake Hoffman, indicted for fake election scheme

Eighteen individuals involved in a conspiracy to overturn Arizona’s election results in 2020 were indicted by a grand jury Wednesday and charged...

Local News

Arizona is home to 3 of the top 10 dude ranches in the country

In a recent ranking by USA Today's 10Best, which showcased the top dude ranches across the nation, Arizona took center stage with three outstanding...

‘Attempted insurrection:’ Republican lawmakers retaliate after Dems’ success on abortion ban repeal

Members of the Arizona Freedom Caucus filed an ethics complaint after Democrats’ vocal push to repeal the ban sparks change. Republican legislators...