AP Photo/Alberto Mariani

“This settlement rights a wrong and puts that money back into the pockets of taxpayers who never should’ve paid to simply file their taxes.”

Even though tax season is over, a number of TurboTax customers can expect to receive a check in the mail this month.

Over 100,000 Arizonans will receive a check worth up to $85 from TurboTax for being overcharged for services as a result of the company’s deceptive marketing practices.

The checks come as a result of a lawsuit settlement between TurboTax and attorneys general from all 50 states and the District of Columbia. Those impacted were low-income consumers eligible for free, federally-supported tax services — but were charged by TurboTax to file their federal returns across 2016, 2017, and 2018.

RELATED: Arizona AG Kris Mayes Revokes Water Permits for Saudi Arabia-Owned Farm

“Every year, millions of taxpayers go online and do exactly what they are supposed to do: file their taxes,” said Attorney General Kris Mayes. “The deceptive practices of TurboTax took advantage of good faith taxpayers and nudged them into giving up some of their hard-earned dollars. This settlement rights a wrong and puts that money back into the pockets of taxpayers who never should’ve paid to simply file their taxes.

Do I Qualify?

Anyone who used TurboTax in 2016, 207, or 2018 that qualified at that time for free tax filing services but was charged is eligible to receive a payment. Qualifying situations for taxpayers who made $73,000 or less during the years listed, with no complex tax situations such as rental property income, crypto investments, or itemized deductions.

For those who aren’t sure, don’t worry: consumers eligible for restitution payments do not need to file a claim. Instead, they will be notified by email from Rust Consulting, the settlement fund administrator, and receive a check automatically.

Checks will be mailed throughout the month of May. The amount paid to each eligible consumer ranges from $29 to $85—depending on the number of tax years they qualify for—with the average amount being $30, according to the Office of the Arizona Attorney General.

Looking for the latest Arizona news? Sign up for our FREE daily newsletter.

Support Our Cause

Thank you for taking the time to read our work. Before you go, we hope you'll consider supporting our values-driven journalism, which has always strived to make clear what's really at stake for Arizonans and our future.

Since day one, our goal here at The Copper Courier has always been to empower people across the state with fact-based news and information. We believe that when people are armed with knowledge about what's happening in their local, state, and federal governments—including who is working on their behalf and who is actively trying to block efforts aimed at improving the daily lives of Arizona families—they will be inspired to become civically engaged.

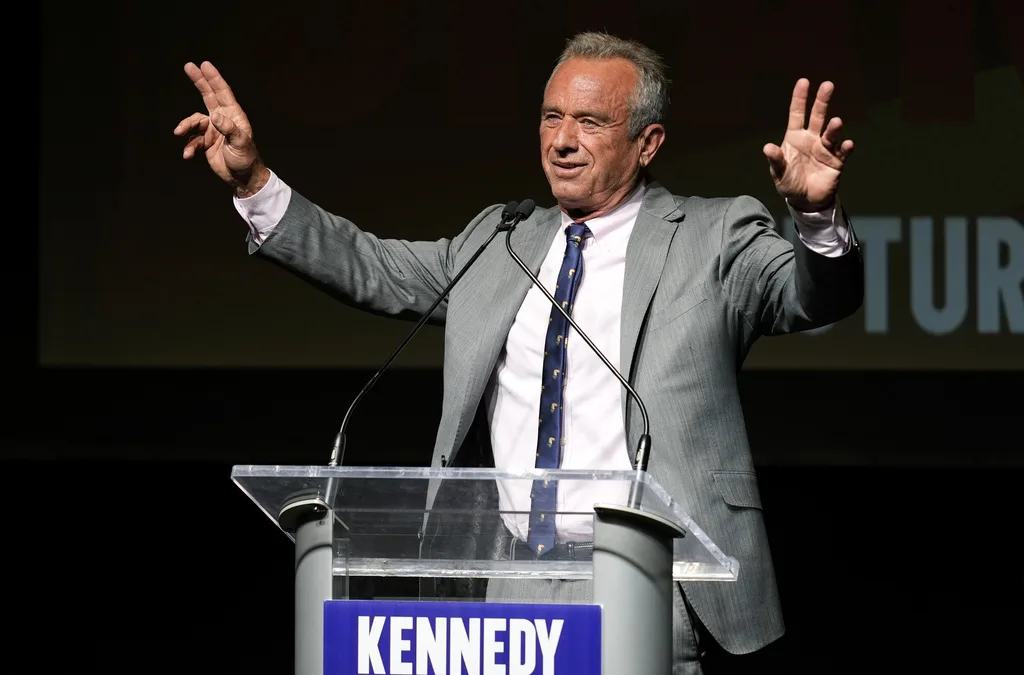

He said what? 10 things to know about RFK Jr.

The Kennedy family has long been considered “Democratic royalty.” But Robert F. Kennedy, Jr.—son of Robert F. Kennedy, who was assassinated while...

Here’s everything you need to know about this month’s Mercury retrograde

Does everything in your life feel a little more chaotic than usual? Or do you feel like misunderstandings are cropping up more frequently than they...

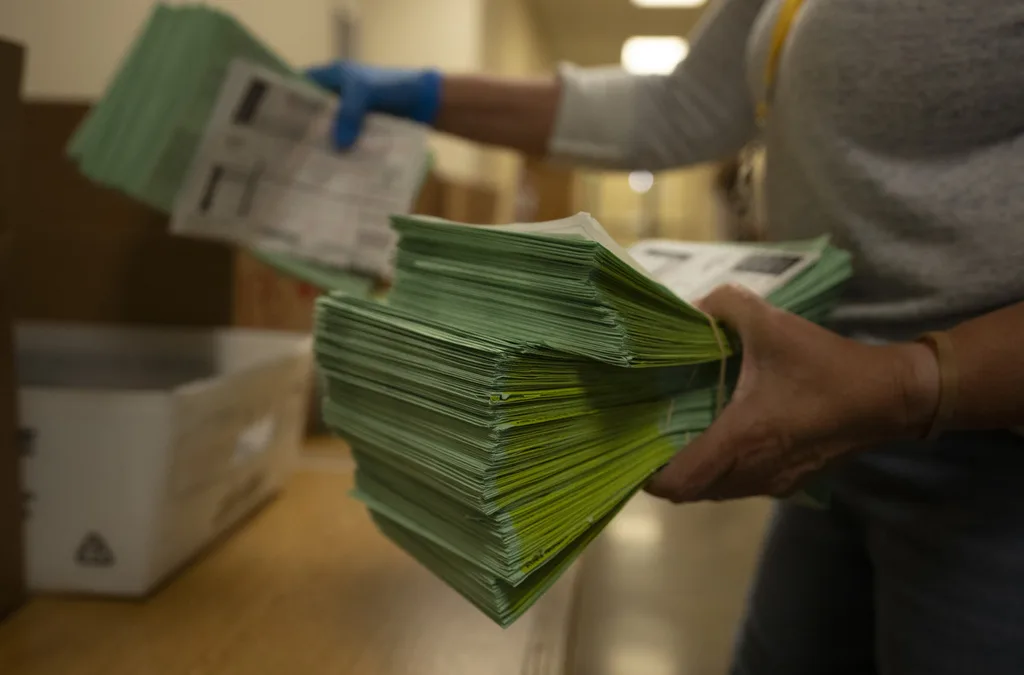

Arizona expects to be back at the center of election attacks. Its officials are going on offense

Republican Richer and Democrat Fontes are taking more aggressive steps than ever to rebuild trust with voters, knock down disinformation, and...

George Santos’ former treasurer running attack ads in Arizona with Dem-sounding PAC name

An unregistered, Republican-run political action committee from Texas with a deceptively Democratic name and ties to disgraced US Rep. George Santos...