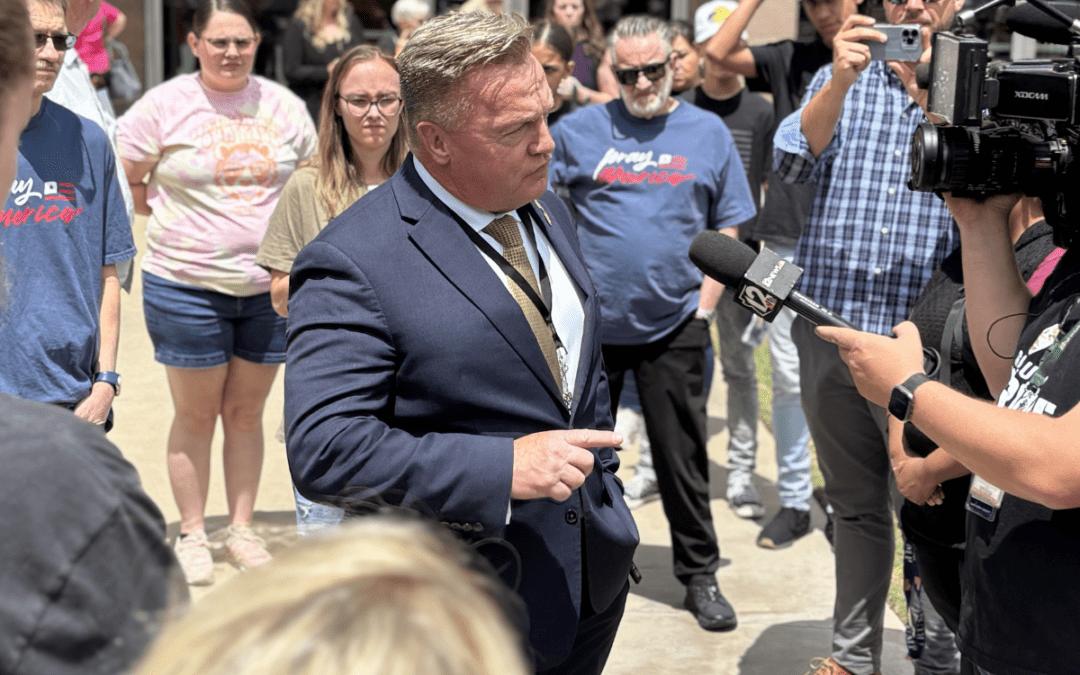

Arizona state Rep. Jeff Weninger, R-Chandler, at the Arizona Capitol. (AP Photo/Bob Christie)

It’s not just Arizona—Republican lawmakers in West Virginia, Kentucky, Idaho, and Utah have also pushed back against investments in companies that prioritize environmental and social sustainability.

Arizona Rep. Jeff Weninger, who is running for state treasurer, has promised to oppose “woke investments.”

In his mind, this means keeping money out of stocks with high ESG—environmental, social, governance—scores.

“I have been concerned with this ESG, environmental, social, governance way of investing,” Weninger, R-Chandler, said to the Arizona Republic. “If you are purposely not investing in profitable businesses and industries, that in and of itself is not holding your fiduciary responsibility to where it should be. You are bypassing profitable industries for the sheer fact that you don’t necessarily agree with their politics.”

But supporters of ESG scores say they are a framework for identifying risk, and that investments in stocks with high scores mean less financial risk for the investor.

Sleeping on Sound Investments

Andrew Behar, CEO of As You Sow, a nonprofit promoting corporate social responsibility, said it would be Weninger’s job as treasurer to reduce risk and get the lowest cost servicing of the state’s debt.

“He is doing just the opposite,” Behar told The Copper Courier. “He is saying, ‘I’m going to waste as much money as possible and increase the risk to the state.’ So I can’t imagine anyone would vote for him based on that platform, because he’s essentially saying, “I’m not going to do my job.”

RELATED: The Copper Courier’s Guide to Voting in Arizona in 2022

Companies with high ESG scores include large, recognizable businesses like Microsoft, Accenture, JB Hunt, and Salesforce.

Investors’ Business Daily’s list of the 100 best ESG companies also includes ON Semiconductor, which is headquartered in Phoenix.

Weninger did not respond to multiple requests for comment.

More Costs in Texas

Behar pointed to Texas as an example of where a similar policy has played out.

The state’s Legislature passed legislation requiring that the state pension fund and treasurer can’t work with banks that restrict funding to fossil-fuel and firearms companies.

“They’re telling them how to think. They’re telling them how to speak. They’re compelling speech,” Behar said of the Texas legislators who supported the law. “This is the ultimate action of big government trying to impose its views on other organizations.”

A study found that this policy cost Texas entities an additional $303-$532 million in interest on the $32 billion in borrowing in the first eight months after the law was passed.

“Essentially it’s going to cost the citizens of Arizona a lot of money,” Behar said of Weninger’s proposal.

Despite the cautionary tale from Texas’ restrictive investment regulations, Republican lawmakers not just in Arizona, but in West Virginia, Kentucky, Idaho, and Utah have pushed back against ESG scores.

“So we’re seeing a trend of state legislators saying, “We want to waste a lot of money. We want our loans to cost us more,” Behar said.

Some Drawbacks

Some financial experts argue that ESG scores—a term that, according to The Economist, has been around since 2004—are not perfect, however.

The introduction to the magazine’s special edition on the topic lays out three criticisms. The first is that by including so many areas of measurement, some companies get unfairly valued over others—for example, an oil company being rated higher than Tesla because of the car company’s corporate governance issues, despite its contributions to reducing emissions.

The second issue is that ESG scores have, in some cases, been misleadingly marketed as always resulting in higher financial performance. And lastly, ESG rating agencies often use different criteria and measurements that can lead to scores varying widely.

But even with these problems, the magazine doesn’t recommend avoiding the measure altogether. It proposes breaking up the areas used for rating and choosing more objective points for measurements, like carbon emissions.

“It is government action, combined with clear and consistent disclosure, that can save the planet, not an abbreviation that is in danger of standing for exaggerated, superficial guff,” the introduction states.

The Other Side

Arizona Sen. Martín Quezada, the only Democratic candidate running for state treasurer, also opposed the idea of fully discounting ESG scores.

“[Weninger’s] proposal is pretty shocking for someone who wants to manage/invest/public money,” Quezada wrote to The Copper Courier. “He’s literally telling us he’s going to use his political opinion and his politics into his decision-making process in how he invests state money by choosing from the very start to extremely limit his options. That’s just bad money management. He’s promising to do a bad job.”

Weninger supported a bill in 2016 that required Arizona to divest from companies that boycott Israel. Originally, before the Legislature made changes in 2019, the law was blocked by a federal judge who argued it likely violated free speech rights.

He also told the Arizona Republic he supports ending the state’s contract with Bank of America because they are anti-gun. The bank announced in 2018 it would no longer loan money to companies that produce “military-style” firearms for civilians.

Quezada argued that Weninger’s policy isn’t actually about ESG scores, which Quezada says “aren’t radical by any stretch of the imagination.”

“Higher ESG scores are sought after precisely because they are typically BETTER investments with greater returns,” he wrote. “What treasurer in his/her right mind would not want that?”

Looking for the latest Arizona news? Sign up for our FREE daily newsletter.

Politics

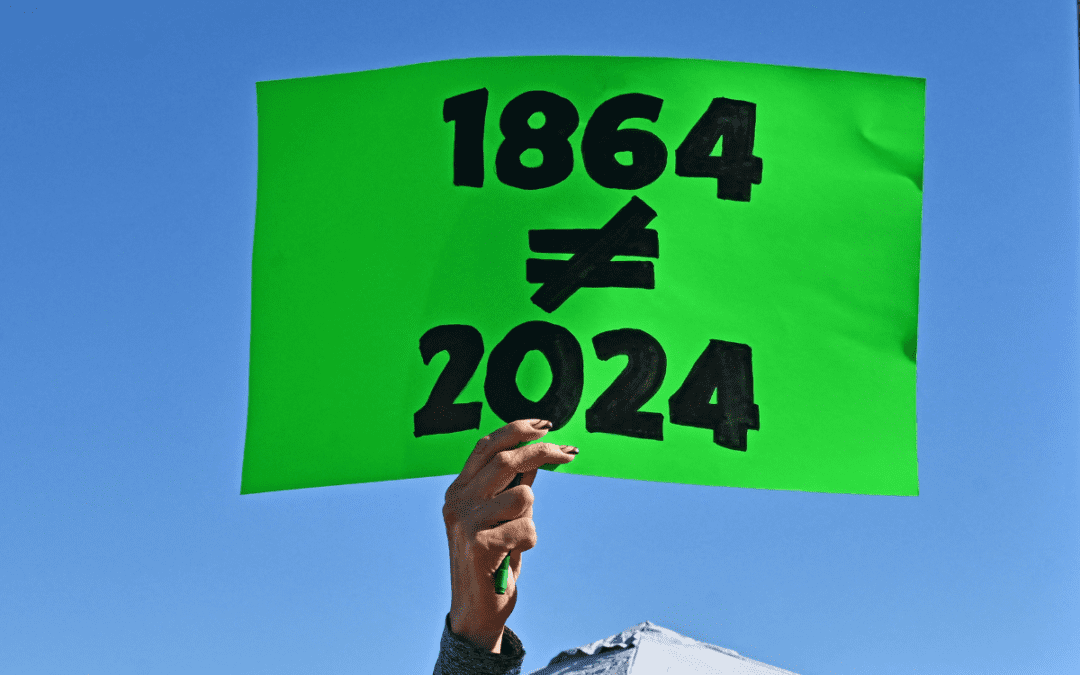

Democrats successfully force vote on repealing 1864 abortion ban, passes House

The Arizona legislature moved forward two bills Wednesday that would repeal the state’s 1864 abortion ban. A bill to repeal the ban has been...

State Official: 1864 abortion ban gives Arizona ‘black eye’

Arizona’s role at the forefront of the climate crisis, defending democratic elections, and protecting reproductive rights has caught the attention...

Local News

Arizona Sens. Anthony Kern, Jake Hoffman, indicted for fake election scheme

Eighteen individuals involved in a conspiracy to overturn Arizona’s election results in 2020 were indicted by a grand jury Wednesday and charged...

Gov. Gavin Newsom wants to let Arizona doctors provide abortions in California

California law generally allows abortion up to the point of fetal viability, which is around 24 weeks. SACRAMENTO, Calif. (AP) — Arizona doctors...