AP Photo/Alberto Mariani

“This settlement rights a wrong and puts that money back into the pockets of taxpayers who never should’ve paid to simply file their taxes.”

Even though tax season is over, a number of TurboTax customers can expect to receive a check in the mail this month.

Over 100,000 Arizonans will receive a check worth up to $85 from TurboTax for being overcharged for services as a result of the company’s deceptive marketing practices.

The checks come as a result of a lawsuit settlement between TurboTax and attorneys general from all 50 states and the District of Columbia. Those impacted were low-income consumers eligible for free, federally-supported tax services — but were charged by TurboTax to file their federal returns across 2016, 2017, and 2018.

RELATED: Arizona AG Kris Mayes Revokes Water Permits for Saudi Arabia-Owned Farm

“Every year, millions of taxpayers go online and do exactly what they are supposed to do: file their taxes,” said Attorney General Kris Mayes. “The deceptive practices of TurboTax took advantage of good faith taxpayers and nudged them into giving up some of their hard-earned dollars. This settlement rights a wrong and puts that money back into the pockets of taxpayers who never should’ve paid to simply file their taxes.

Do I Qualify?

Anyone who used TurboTax in 2016, 207, or 2018 that qualified at that time for free tax filing services but was charged is eligible to receive a payment. Qualifying situations for taxpayers who made $73,000 or less during the years listed, with no complex tax situations such as rental property income, crypto investments, or itemized deductions.

For those who aren’t sure, don’t worry: consumers eligible for restitution payments do not need to file a claim. Instead, they will be notified by email from Rust Consulting, the settlement fund administrator, and receive a check automatically.

Checks will be mailed throughout the month of May. The amount paid to each eligible consumer ranges from $29 to $85—depending on the number of tax years they qualify for—with the average amount being $30, according to the Office of the Arizona Attorney General.

Looking for the latest Arizona news? Sign up for our FREE daily newsletter.

Politics

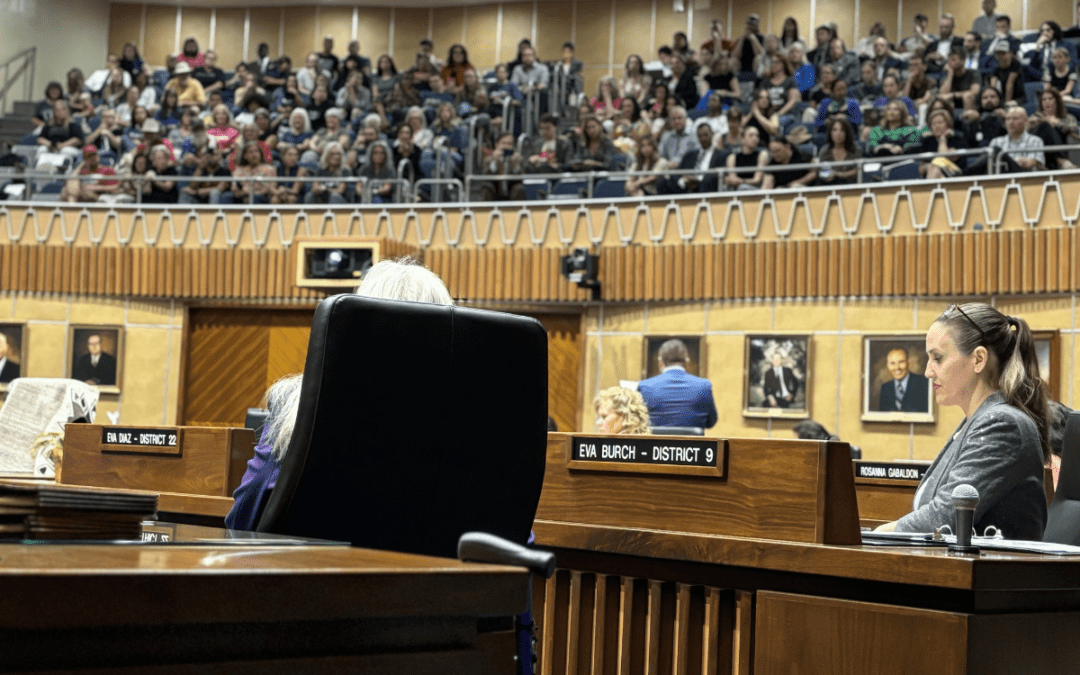

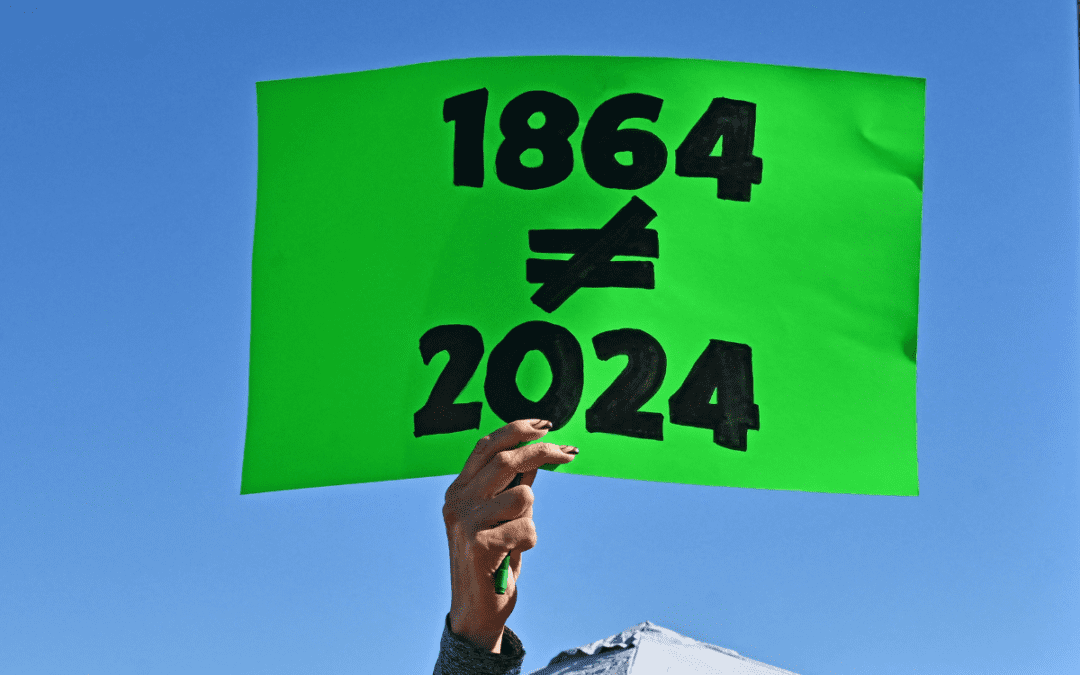

Democrats successfully force vote on repealing 1864 abortion ban, passes House

The Arizona legislature moved forward two bills Wednesday that would repeal the state’s 1864 abortion ban. A bill to repeal the ban has been...

State Official: 1864 abortion ban gives Arizona ‘black eye’

Arizona’s role at the forefront of the climate crisis, defending democratic elections, and protecting reproductive rights has caught the attention...

Local News

Arizona Sens. Anthony Kern, Jake Hoffman, indicted for fake election scheme

Eighteen individuals involved in a conspiracy to overturn Arizona’s election results in 2020 were indicted by a grand jury Wednesday and charged...

Gov. Gavin Newsom wants to let Arizona doctors provide abortions in California

California law generally allows abortion up to the point of fetal viability, which is around 24 weeks. SACRAMENTO, Calif. (AP) — Arizona doctors...